Question: Check my work 15 Problem 03-21 (Static) (LO 3-3, 3-5) 0.76 Firm Y has the opportunity to invest in a new venture. The projected cash

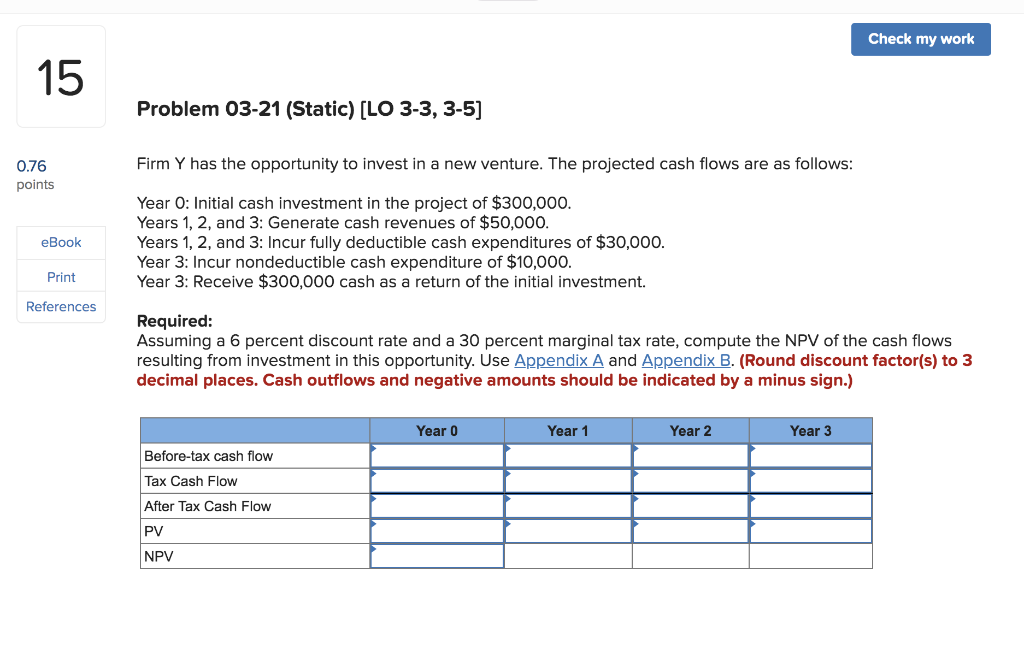

Check my work 15 Problem 03-21 (Static) (LO 3-3, 3-5) 0.76 Firm Y has the opportunity to invest in a new venture. The projected cash flows are as follows: points eBook Year 0: Initial cash investment in the project of $300,000. Years 1, 2, and 3: Generate cash revenues of $50,000. Years 1, 2, and 3: Incur fully deductible cash expenditures of $30,000. Year 3: Incur nondeductible cash expenditure of $10,000. Year 3: Receive $300,000 cash as a return of the initial investment. Print References Required: Assuming a 6 percent discount rate and a 30 percent marginal tax rate, compute the NPV of the cash flows resulting from investment in this opportunity. Use Appendix A and Appendix B. (Round discount factor(s) to 3 decimal places. Cash outflows and negative amounts should be indicated by a minus sign.) Year 0 Year 1 Year 2 Year 3 Before-tax cash flow Tax Cash Flow After Tax Cash Flow PV NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts