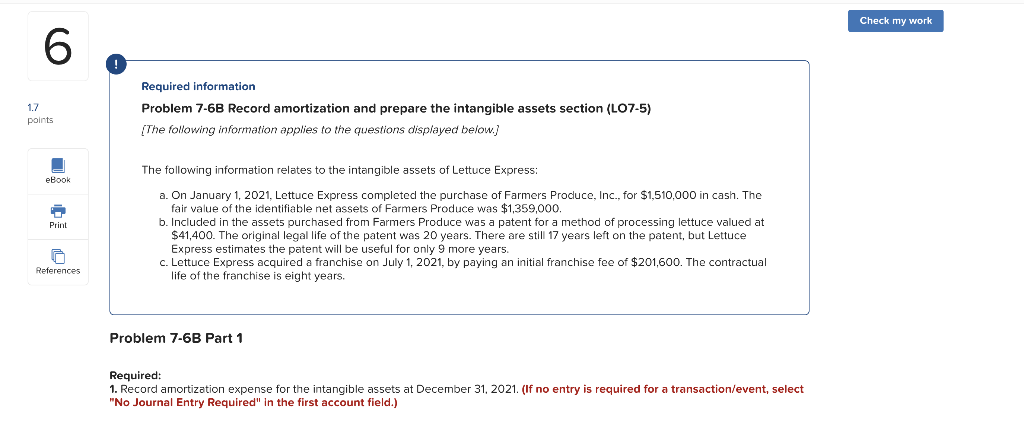

Question: Check my work 17 Required information Problem 7-6B Record amortization and prepare the intangible assets section (LO7-5) (The following information applies to the questions displayed

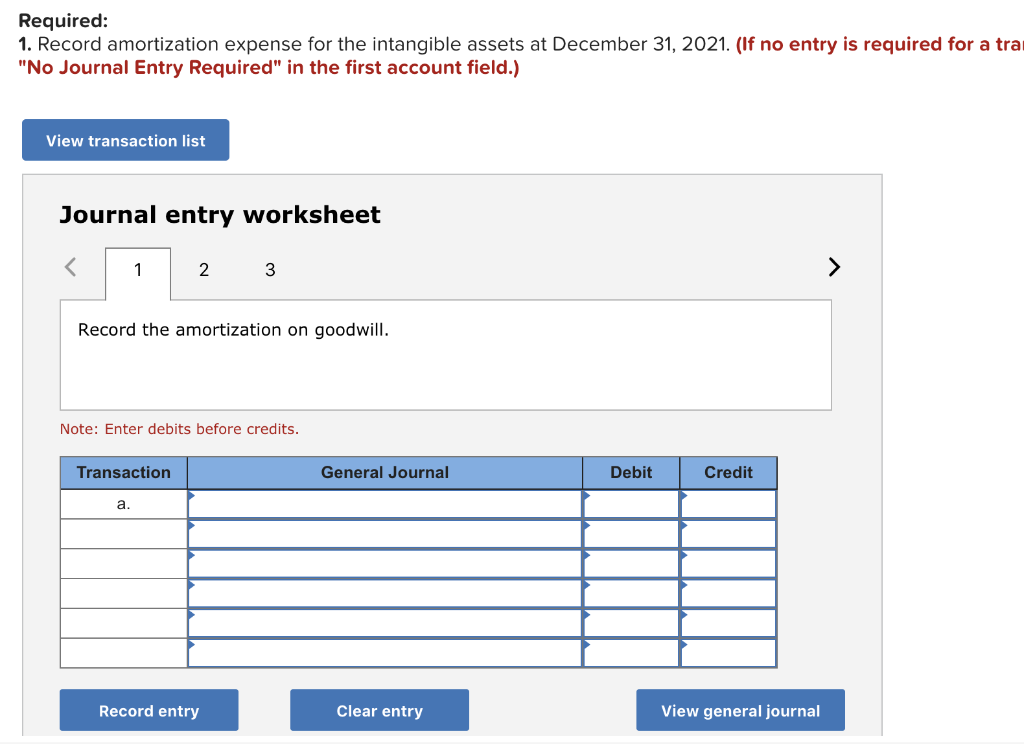

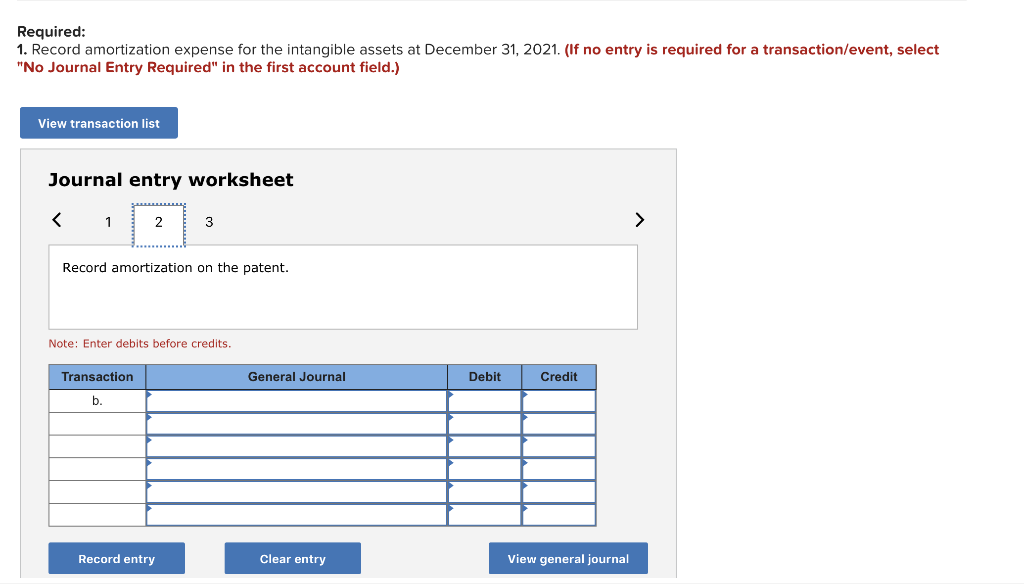

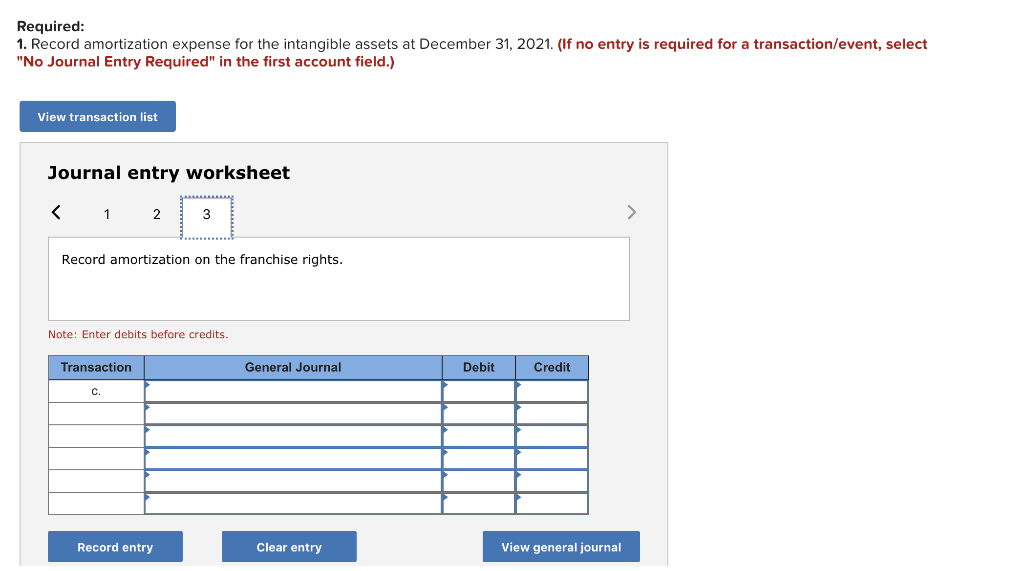

Check my work 17 Required information Problem 7-6B Record amortization and prepare the intangible assets section (LO7-5) (The following information applies to the questions displayed below.) points The following information relates to the intangible assets of Lettuce Express: eBook Print a. On January 1, 2021, Lettuce Express completed the purchase of Farmers Produce, Inc., for $1,510,000 in cash. The fair value of the identifiable net assets of Farmers Produce was $1,359,000. b. Included in the assets purchased from Farmers Produce was a patent for a method of processing lettuce valued at $41,400. The original legal life of the patent was 20 years. There are still 17 years left on the patent, but Lettuce Express estimates the patent will be useful for only 9 more years c. Lettuce Express acquired a franchise on July 1, 2021, by paying an initial franchise fee of $ 201,600. The contractual life of the franchise is eight years. References Problem 7-6B Part 1 Required: 1. Record amortization expense for the intangible assets at December 31, 2021. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required: 1. Record amortization expense for the intangible assets at December 31, 2021. (If no entry is required for a tra "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 Record the amortization on goodwill. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal Required: 1. Record amortization expense for the intangible assets at December 31, 2021. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record amortization on the patent. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Required: 1. Record amortization expense for the intangible assets at December 31, 2021. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts