Question: Check my work 22 The margin requirement on the S&P 500 futures contract is 16%, and the stock index is currently 2,100. Each contract has

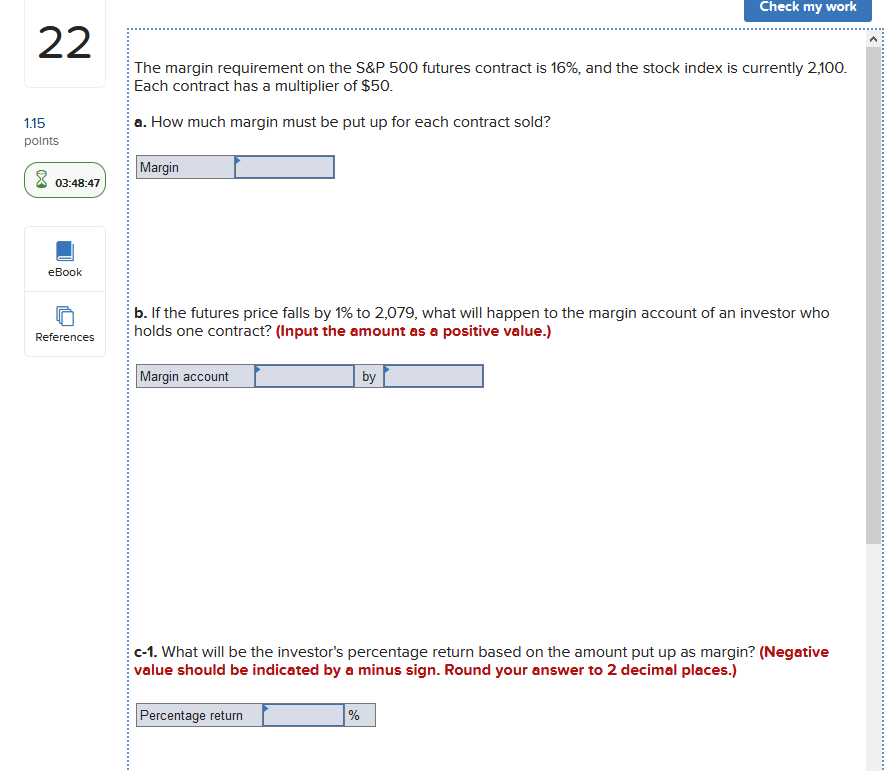

Check my work 22 The margin requirement on the S&P 500 futures contract is 16%, and the stock index is currently 2,100. Each contract has a multiplier of $50. a. How much margin must be put up for each contract sold? 1.15 points Margin (8 03:48:47 eBook b. If the futures price falls by 1% to 2,079, what will happen to the margin account of an investor who holds one contract? (Input the amount as a positive value.) References Margin account | by C-1. What will be the investor's percentage return based on the amount put up as margin? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Percentage return Check my work 22 The margin requirement on the S&P 500 futures contract is 16%, and the stock index is currently 2,100. Each contract has a multiplier of $50. a. How much margin must be put up for each contract sold? 1.15 points Margin (8 03:48:47 eBook b. If the futures price falls by 1% to 2,079, what will happen to the margin account of an investor who holds one contract? (Input the amount as a positive value.) References Margin account | by C-1. What will be the investor's percentage return based on the amount put up as margin? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Percentage return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts