Question: Check my work 6 10 points A pension plan is obligated to make disbursements of $2.1 million, $3.1 million, and $2.1 million at the end

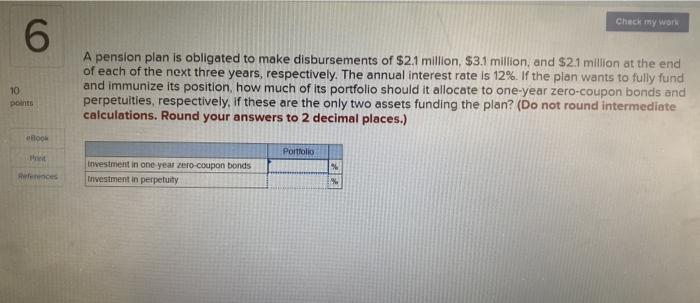

Check my work 6 10 points A pension plan is obligated to make disbursements of $2.1 million, $3.1 million, and $2.1 million at the end of each of the next three years, respectively. The annual interest rate is 12%. If the plan wants to fully fund and immunize its position how much of its portfolio should it allocate to one-year zero-coupon bonds and perpetuities, respectively, if these are the only two assets funding the plan? (Do not round intermediate calculations. Round your answers to 2 decimal places.) flook Portfolio it Heferences investment in one year zero-coupon bonds Investment in perpetuity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock