Question: Check my work 6 E4-7 (Algo) Determining Financial Statement Effects of Adjusting Entries LO4-1 nts Book 1. Dodie Company completed its first year of operations

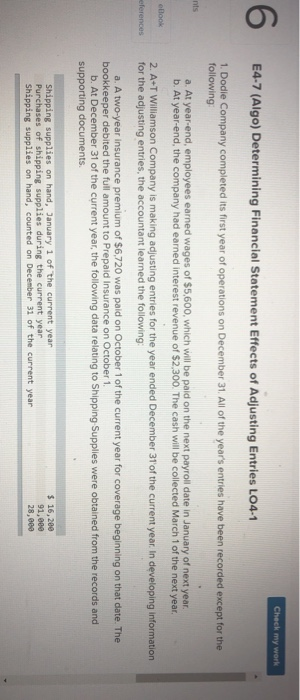

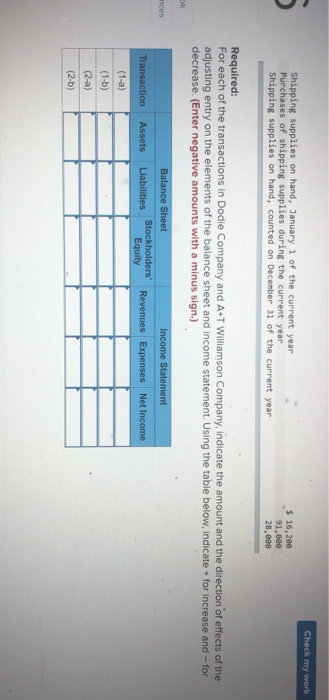

Check my work 6 E4-7 (Algo) Determining Financial Statement Effects of Adjusting Entries LO4-1 nts Book 1. Dodie Company completed its first year of operations on December 31. All of the year's entries have been recorded except for the following a. At year-end, employees earned wages of $5,600, which will be paid on the next payroll date in January of next year. b. At year-end, the company had earned interest revenue of $2,300. The cash will be collected March 1 of the next year, 2. A+T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: a. A two-year insurance premium of $6,720 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1 b. At December 31 of the current year, the following data relating to Shipping Supples were obtained from the records and supporting documents eferences Shipping supplies on hand, January 1 of the current year Purchases of shipping supplies during the current year Shipping supplies on hand, counted on December 31 of the current year $ 16, 200 91,800 28,000 Check my work 5. Shipping supplies on hand, January 1 of the current year Purchases of shipping supplies during the current year Shipping supplies on hand, counted on December 31 of the current year $ 16,200 91,eee 28,000 Required: For each of the transactions in Dodie Company and A+T Williamson Company, indicate the amount and the direction of effects of the adjusting entry on the elements of the balance sheet and income statement. Using the table below, indicate + for increase and - for decrease. (Enter negative amounts with a minus sign.) inces Balance Sheet Stockholders Assets Liabilities Equity Income Statement Revenues Expenses Net Income Transaction (1-a) (1-5) (2-a) (2-b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts