Question: Check my work 7 S06-04 Calculating Annuity Present Value [LO1] 10 An investment offers $4,350 per year for 15 years, with the first payment occurring

![Check my work 7 S06-04 Calculating Annuity Present Value [LO1] 10](https://s3.amazonaws.com/si.experts.images/answers/2024/06/667fcbb0eb7d0_248667fcbb0c9d62.jpg)

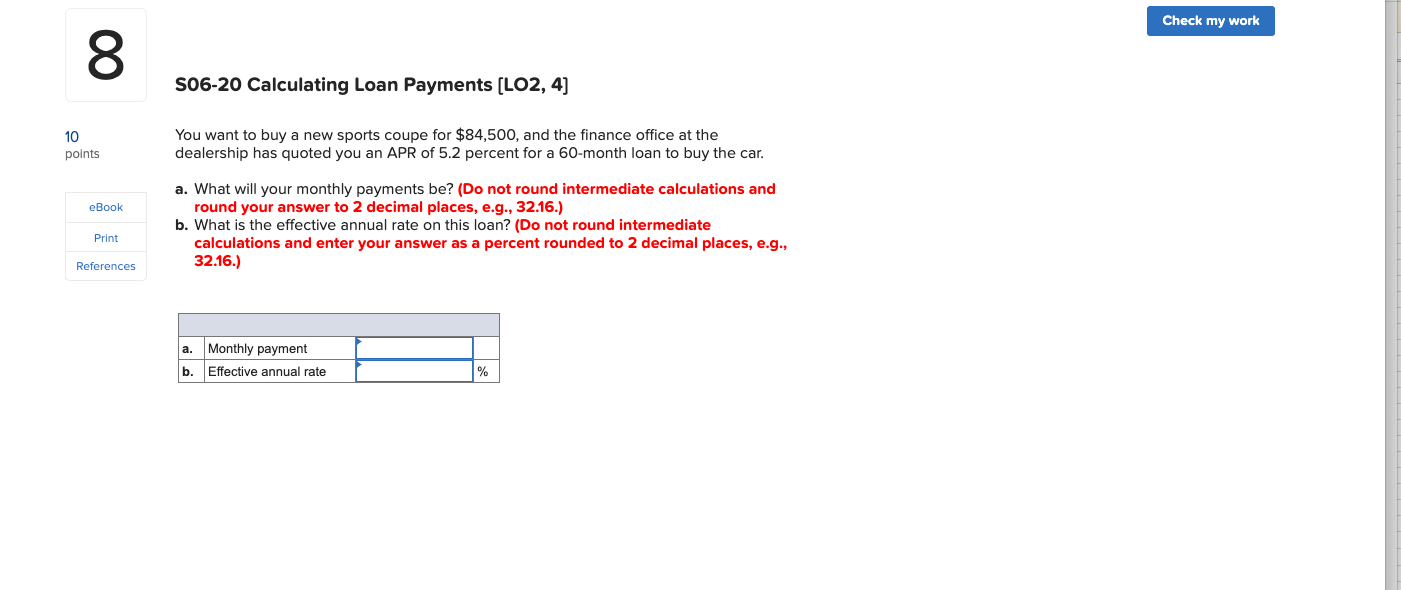

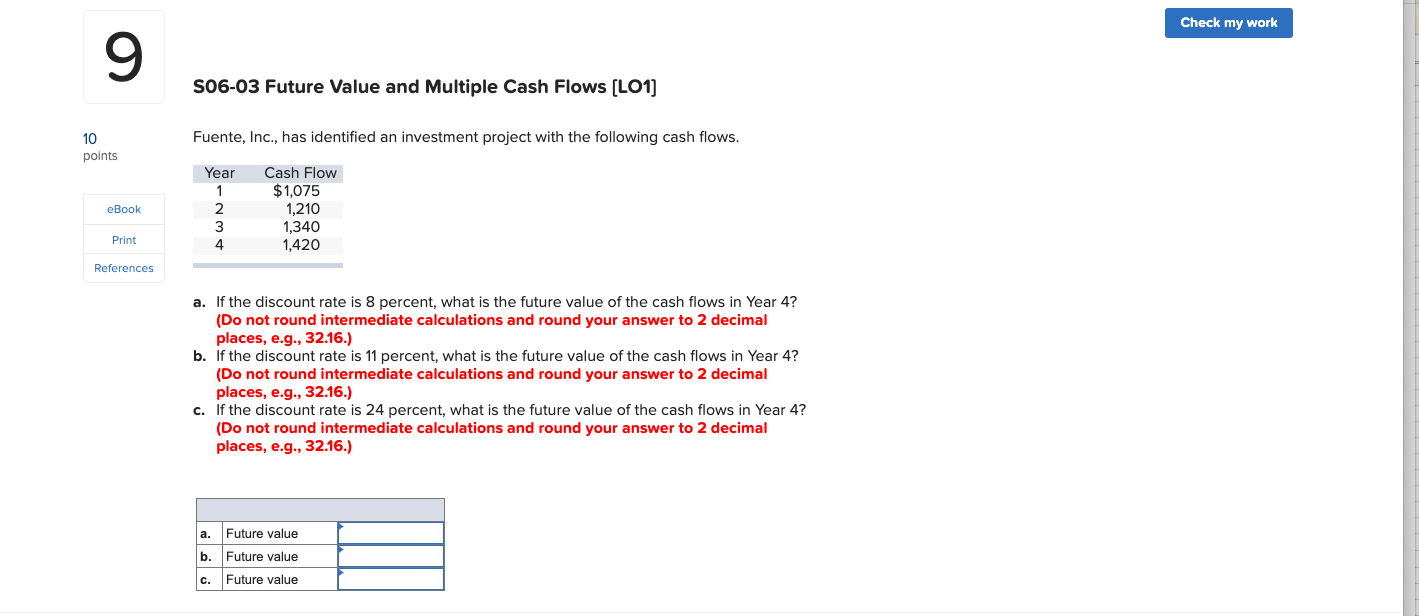

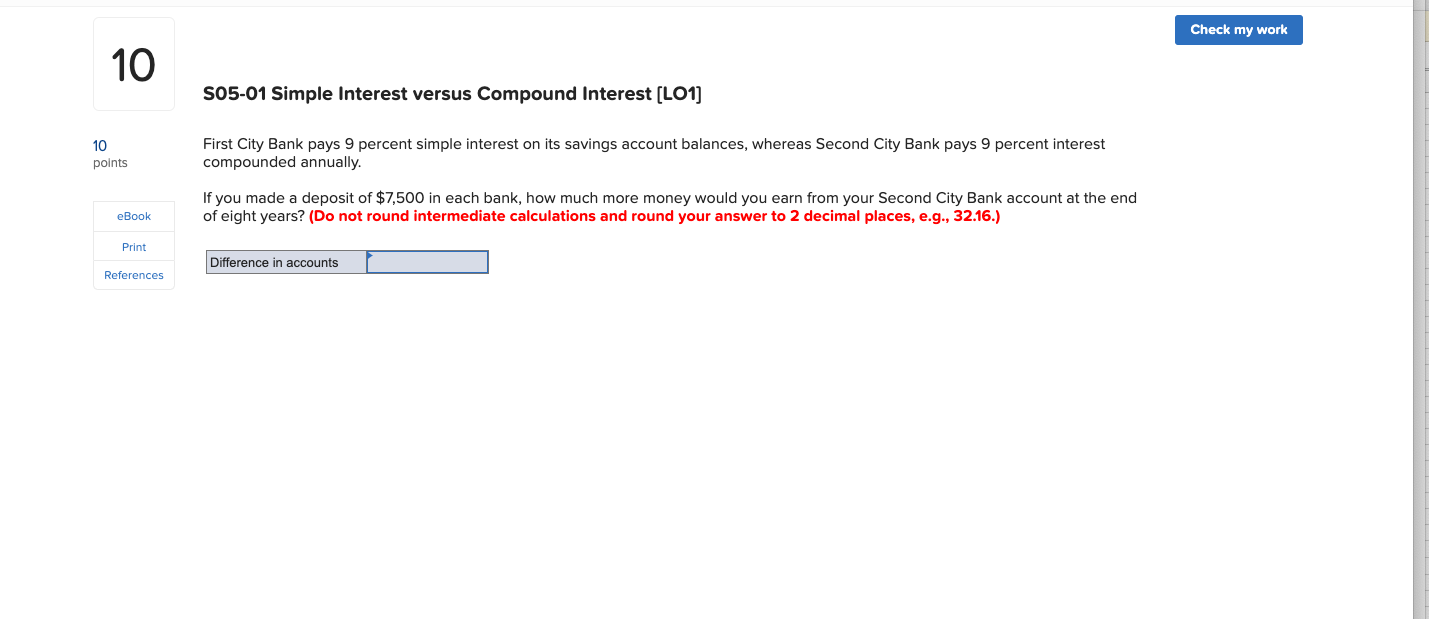

Check my work 7 S06-04 Calculating Annuity Present Value [LO1] 10 An investment offers $4,350 per year for 15 years, with the first payment occurring one points year from now. a. If the required return is 6 percent, what is the value of the investment? (Do not round eBook intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What would the value be if the payments occurred for 40 years? (Do not round Hint intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Print c. What would the value be if the payments occurred for 75 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) References d. What would the value be if the payments occurred forever? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Present value b. Present value C. Present value d. Present valueCheck my work 8 S06-20 Calculating Loan Payments [LO2, 4] 10 You want to buy a new sports coupe for $84,500, and the finance office at the points dealership has quoted you an APR of 5.2 percent for a 60-month loan to buy the car. a. What will your monthly payments be? (Do not round intermediate calculations and eBook round your answer to 2 decimal places, e.g., 32.16.) b. What is the effective annual rate on this loan? (Do not round intermediate Print calculations and enter your answer as a percent rounded to 2 decimal places, e.g., References 32.16.) a. Monthly payment b. Effective annual rate %Check my work 9 S06-03 Future Value and Multiple Cash Flows [LO1] 10 Fuente, Inc., has identified an investment project with the following cash flows. points Year Cash Flow 1 $1,075 eBook 1,210 1,340 Print 1,420 References a. If the discount rate is 8 percent, what is the future value of the cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the discount rate is 11 percent, what is the future value of the cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If the discount rate is 24 percent, what is the future value of the cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Future value b. Future value C. Future valueCheck my work 10 505-01 Simple Interest versus Compound Interest [LO1] 10 First City Bank pays 9 percent simple interest on its savings account balances, whereas Second City Bank pays 9 percent interest points compounded annually. If you made a deposit of $7,500 in each bank, how much more money would you earn from your Second City Bank account at the end eBook of eight years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Print Difference in accounts References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts