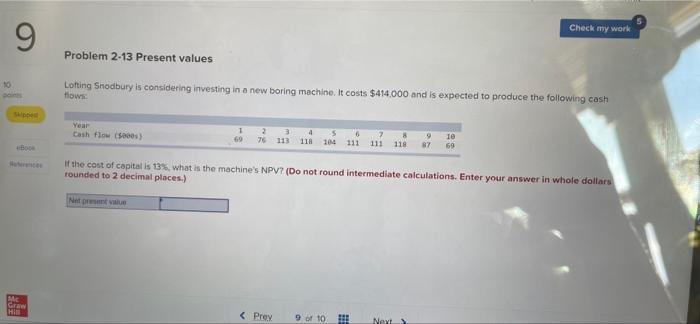

Question: Check my work 9 Problem 2-13 Present values 10 Lotting Snodbury is considering investing in a new boring machine. It costs $414,000 and is expected

Check my work 9 Problem 2-13 Present values 10 Lotting Snodbury is considering investing in a new boring machine. It costs $414,000 and is expected to produce the following cash Hows Year Cash flow (5000) 1 69 2 3 4 76113 118 s 6 2 104 111 111 118 9 87 169 If the cost of capital is 13% what is the machine's NPV? (Do not round intermediate calculations. Enter your answer in whole dollars rounded to 2 decimal places.) Net ME G HI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts