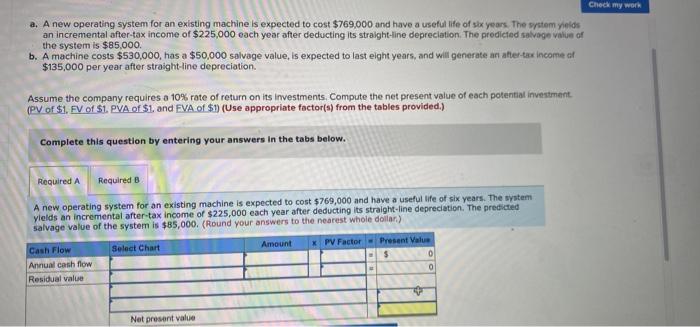

Question: Check my work a. A new operating system for an existing machine is expected to cost $769,000 and have a useful life of six years.

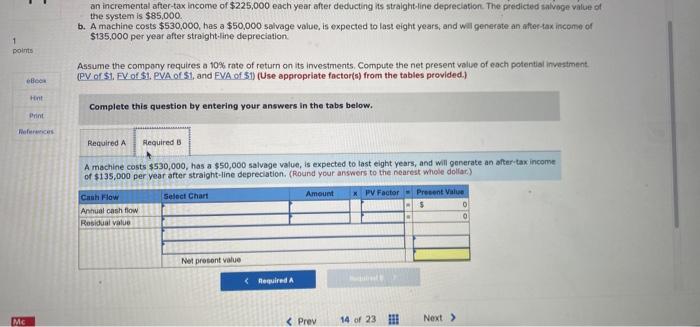

Check my work a. A new operating system for an existing machine is expected to cost $769,000 and have a useful life of six years. The system yields an incremental after-tax income of $225,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $85,000. b. A machine costs $530,000, has a $50,000 selvage value, is expected to last eight years, and will generate an alter-tax income al $135,000 per year after straight-line depreciation. Assume the company requires a 10% rate of return on its investments, Compute the net present value of each potential investment PV of $1. FV of St. PVA of $1. and EVA of $1] (Use appropriate factor(s) from the tables provided.) Complete this question by entering your answers in the tabs below. Required A Required B A new operating system for an existing machine is expected to cost $769,000 and have a useful life of six years. The system ylelds an incremental after-tax income of $225,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $85,000. (Round your answers to the nearest whole dollar) Amount * PV Factor - Present Value Select Chart 0 Cash Flow Annual cash flow Residual value 0 Net present value an incremental after-tax income of $225,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $85,000 b. A machine costs $530,000, has a $50,000 salvage value, is expected to last eight years, and will generate an after-tax income of $135,000 per year after straight-line depreciation 1 points Assume the company requires a 10% rate of return on its investments. Compute the net present value of each potential investment (PV of S1. FV of $1. PVA of S1, and EVA of 51) (Use appropriate factor(s) from the tables provided.) Bees Hint Complete this question by entering your answers in the tabs below. Print References Required A Required B A machine costs $530,000, has a $50,000 salvage value is expected to tast eight years, and will generate an after tax income of $135,000 per year after straight-line depreciation (Round your answers to the nearest whole dollar) Select Chart Amount X PV Factor - Present Value $ 0 Cash Flow Annual cash flow Residual value Not procent value Required A MC Check my work a. A new operating system for an existing machine is expected to cost $769,000 and have a useful life of six years. The system yields an incremental after-tax income of $225,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $85,000. b. A machine costs $530,000, has a $50,000 selvage value, is expected to last eight years, and will generate an alter-tax income al $135,000 per year after straight-line depreciation. Assume the company requires a 10% rate of return on its investments, Compute the net present value of each potential investment PV of $1. FV of St. PVA of $1. and EVA of $1] (Use appropriate factor(s) from the tables provided.) Complete this question by entering your answers in the tabs below. Required A Required B A new operating system for an existing machine is expected to cost $769,000 and have a useful life of six years. The system ylelds an incremental after-tax income of $225,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $85,000. (Round your answers to the nearest whole dollar) Amount * PV Factor - Present Value Select Chart 0 Cash Flow Annual cash flow Residual value 0 Net present value an incremental after-tax income of $225,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $85,000 b. A machine costs $530,000, has a $50,000 salvage value, is expected to last eight years, and will generate an after-tax income of $135,000 per year after straight-line depreciation 1 points Assume the company requires a 10% rate of return on its investments. Compute the net present value of each potential investment (PV of S1. FV of $1. PVA of S1, and EVA of 51) (Use appropriate factor(s) from the tables provided.) Bees Hint Complete this question by entering your answers in the tabs below. Print References Required A Required B A machine costs $530,000, has a $50,000 salvage value is expected to tast eight years, and will generate an after tax income of $135,000 per year after straight-line depreciation (Round your answers to the nearest whole dollar) Select Chart Amount X PV Factor - Present Value $ 0 Cash Flow Annual cash flow Residual value Not procent value Required A MC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts