Question: Check my work Businesses using the allowance method for the recognition of uncollectible accounts expense commonly experience four accounting events: a. Recognition of uncollectible accounts

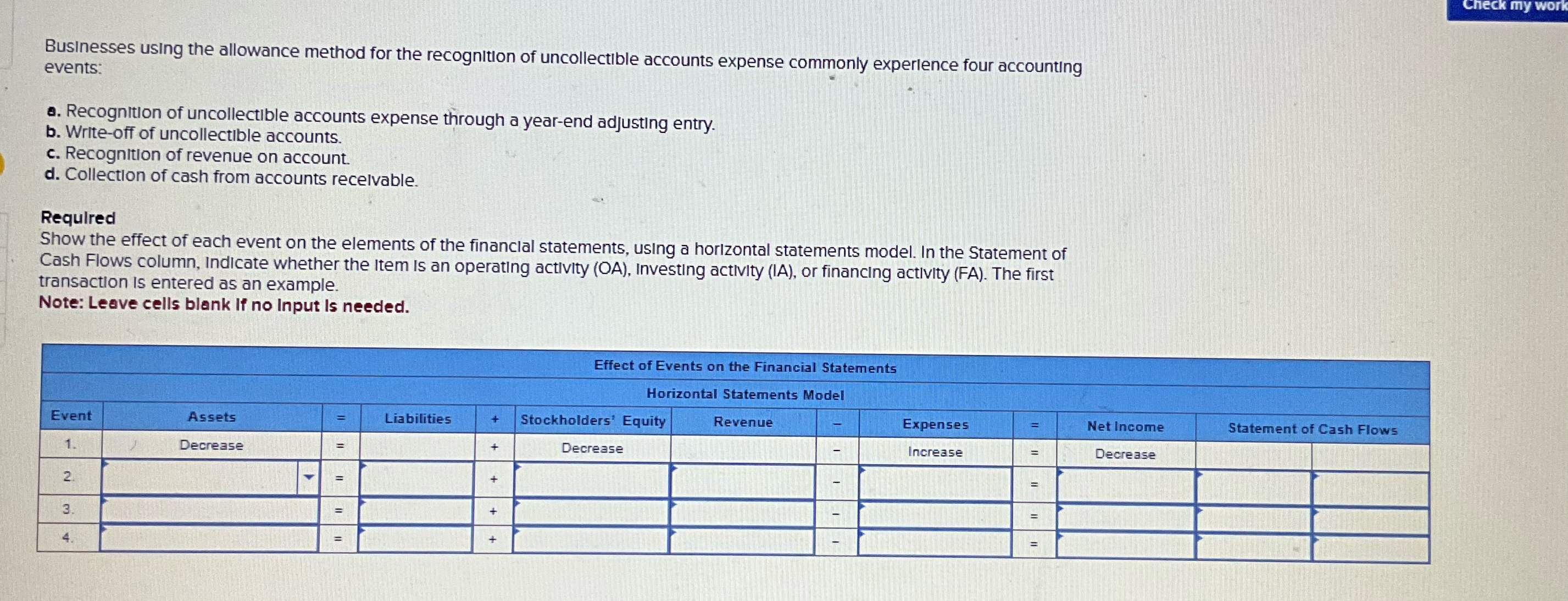

Check my work Businesses using the allowance method for the recognition of uncollectible accounts expense commonly experience four accounting events: a. Recognition of uncollectible accounts expense through a year-end adjusting entry. b. Write-off of uncollectible accounts. c. Recognition of revenue on account. d. Collection of cash from accounts receivable. Required Show the effect of each event on the elements of the financial statements, using a horizontal statements model. In the Statement of Cash Flows column, Indicate whether the Item is an operating activity (OA), Investing activity (IA), or financing activity (FA). The first transaction is entered as an example. Note: Leave cells blank If no Input Is needed. Effect of Events on the Financial Statements Horizontal Statements Model Event Assets Liabilities + Stockholders Equity Revenue Expenses Net Income Statement of Cash Flows Decrease Increase Decrease 1. Decrease 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts