Question: Check My Work eBook Problem Walk-Through Problem 5-12 Bond Yields and Rates of Return A 15-year, 14% semiannual coupon bond with a par value of

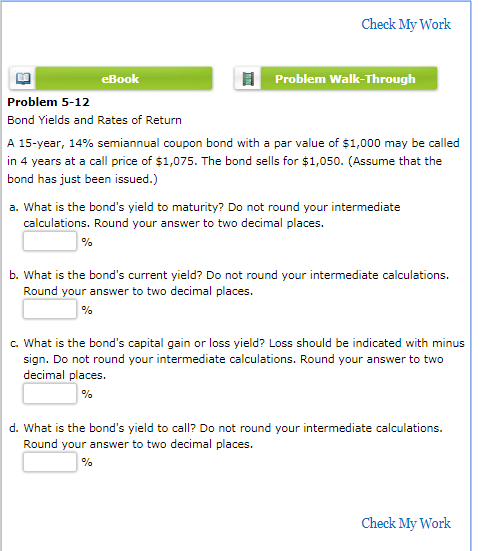

Check My Work eBook Problem Walk-Through Problem 5-12 Bond Yields and Rates of Return A 15-year, 14% semiannual coupon bond with a par value of $1,000 may be called in 4 years at a call price of $1,075. The bond sells for $1,050. (Assume that the bond has just been issued.) calculations. Round your answer to two decimal places. b. What is the bond's current yield? Do not round your intermediate calculations. Round your answer to two decimal places. c. What is the bond's capital gain or loss yield? Loss should be indicated with minus sign. Do not round your intermediate calculations. Round your answer to two decimal places d. What is the bond's yield to call? Do not round your intermediate calculations Round your answer to two decimal places. Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts