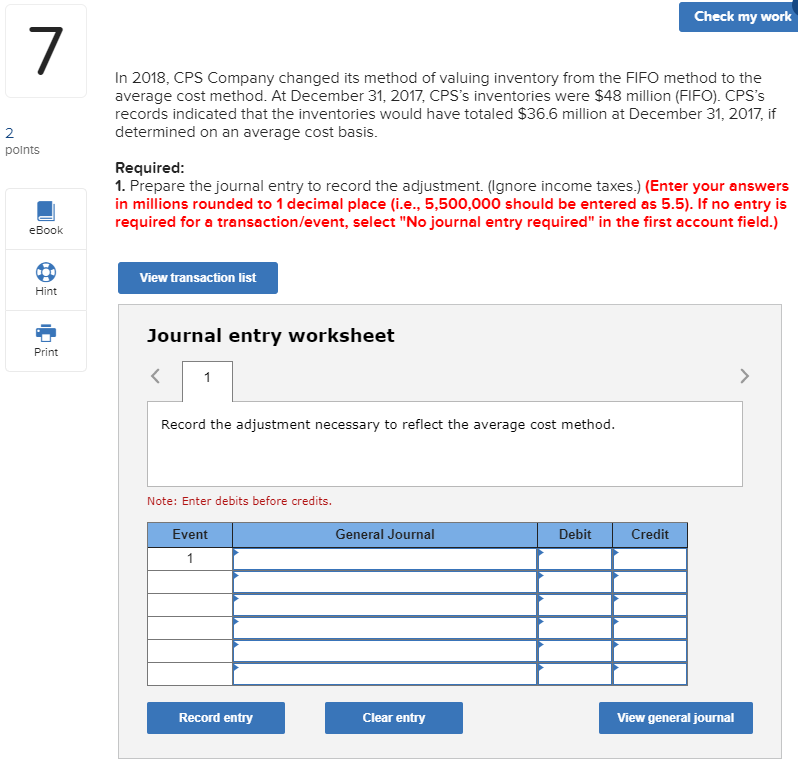

Question: Check my work In 2018, CPS Company changed its method of valuing inventory from the FIFO method to the average cost method. At December 31,

Check my work In 2018, CPS Company changed its method of valuing inventory from the FIFO method to the average cost method. At December 31, 2017, CPS's inventories were $48 million (FIFO). CPS's records indicated that the inventories would have totaled $36.6 million at December 31, 2017, if determined on an average cost basis. points Required: 1. Prepare the journal entry to record the adjustment. (Ignore income taxes.) (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) eBook View transaction list Hint Journal entry worksheet Print Record the adjustment necessary to reflect the average cost method. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts