Question: Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

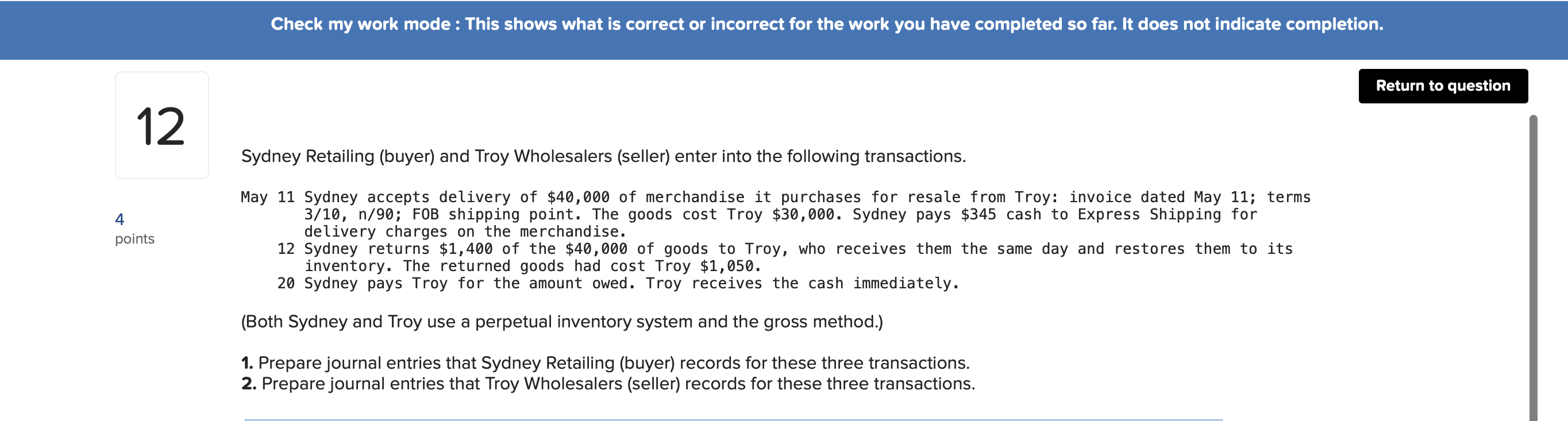

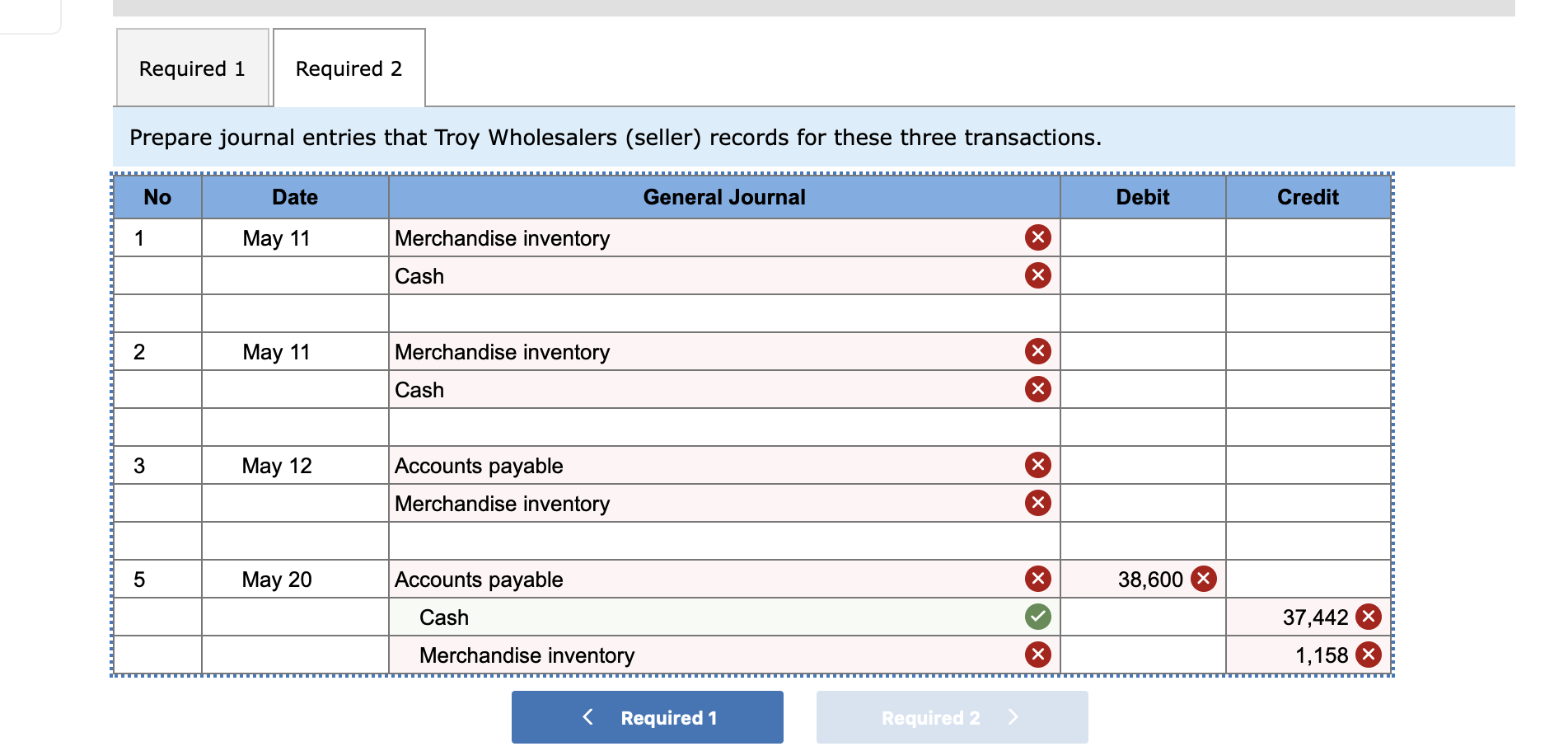

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 12 Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. 4 points May 11 Sydney accepts delivery of $40,000 of merchandise it purchases for resale from Troy: invoice dated May 11; terms 3/10, n/90; FOB shipping point. The goods cost Troy $30,000. Sydney pays $345 cash to Express Shipping for delivery charges on the merchandise. 12 Sydney returns $1,400 of the $40,000 of goods to Troy, who receives them the same day and restores them to its inventory. The returned goods had cost Troy $1,050. 20 Sydney pays Troy for the amount owed. Troy receives the cash immediately. (Both Sydney and Troy use a perpetual inventory system and the gross method.) 1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions. 2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions. Required 1 Required 2 Prepare journal entries that Troy Wholesalers (seller) records for these three transactions. No Date General Journal Debit Credit 1 May 11 Merchandise inventory Cash 2 May 11 Merchandise inventory Cash X 3 May 12 Accounts payable Merchandise inventory 5 May 20 Accounts payable 38,600 Cash 37,442 1,158 X Merchandise inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts