Question: Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

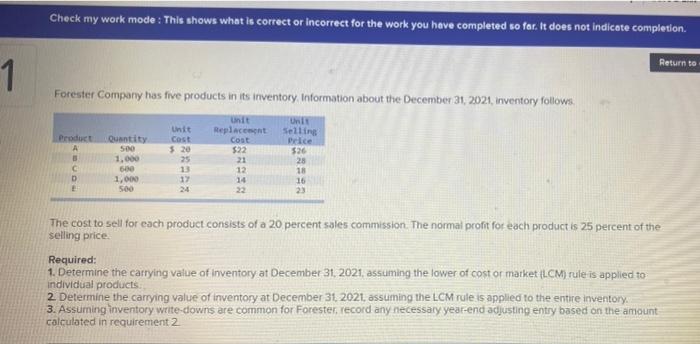

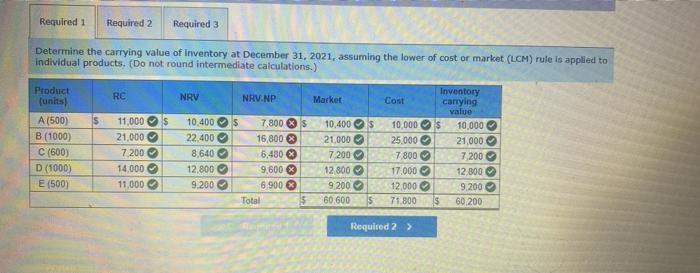

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to 1 Forester Company has five products in its inventory Information about the December 31, 2021, Inventory follows. Product A Quantity 500 1.000 600 1,000 500 unit Cost 5 20 25 13 12 24 unit Replacet Cost $22 21 12 14 Unit Selling Police 526 28 18 16 D The cost to sell for each product consists of a 20 percent sales commission. The normal profit for each product is 25 percent of the selling price Required: 1. Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or market (LCM) rule is applied to individual products 2. Determine the carrying value of inventory at December 31, 2021, assuming the LCM rule is applied to the entire inventory 3. Assuming inventory write-downs are common for Forester record any necessary year-end adjusting entry based on the amount calculated in requirement 2 Required 1 Required 2 Required 3 Determine the carrying value of Inventory at December 31, 2021, assuming the lower of cost or market (LCM) rule is applied to individual products. (Do not round intermediate calculations.) RC NRV NRV.NP Market Cost $ Product units) A (500) B (1000) C (600) D (1000) E (500) 11,000 $ 21,000 7 200 14,000 11,000 10.400 22.400 8,640 12.800 9.200 7.800 X $ 16,800 6,480 % 9,600 % 6.900 Total 5 10,400 21000 7 200 12800 9200 60,600 10,000 25.000 7 800 17.000 12.000 71.800 Inventory carrying value $ 10,000 21,000 7,200 12,800 9,200 $ 60 200 $ s Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts