Question: Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

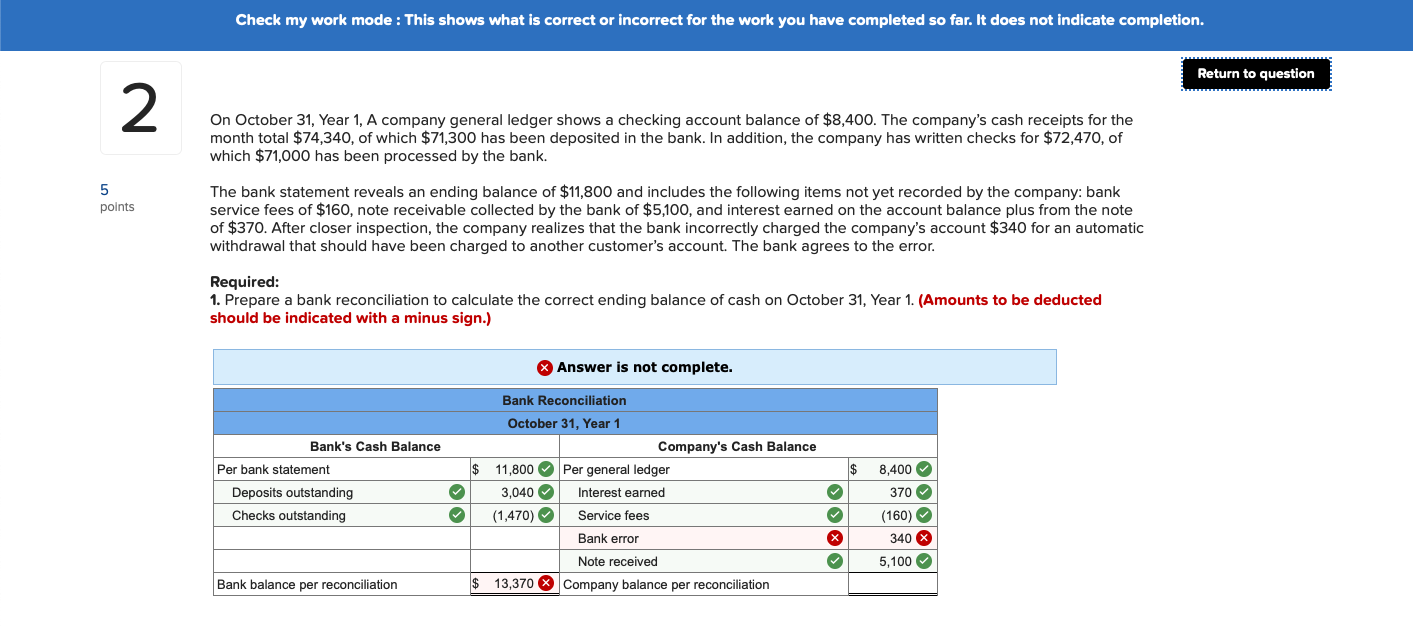

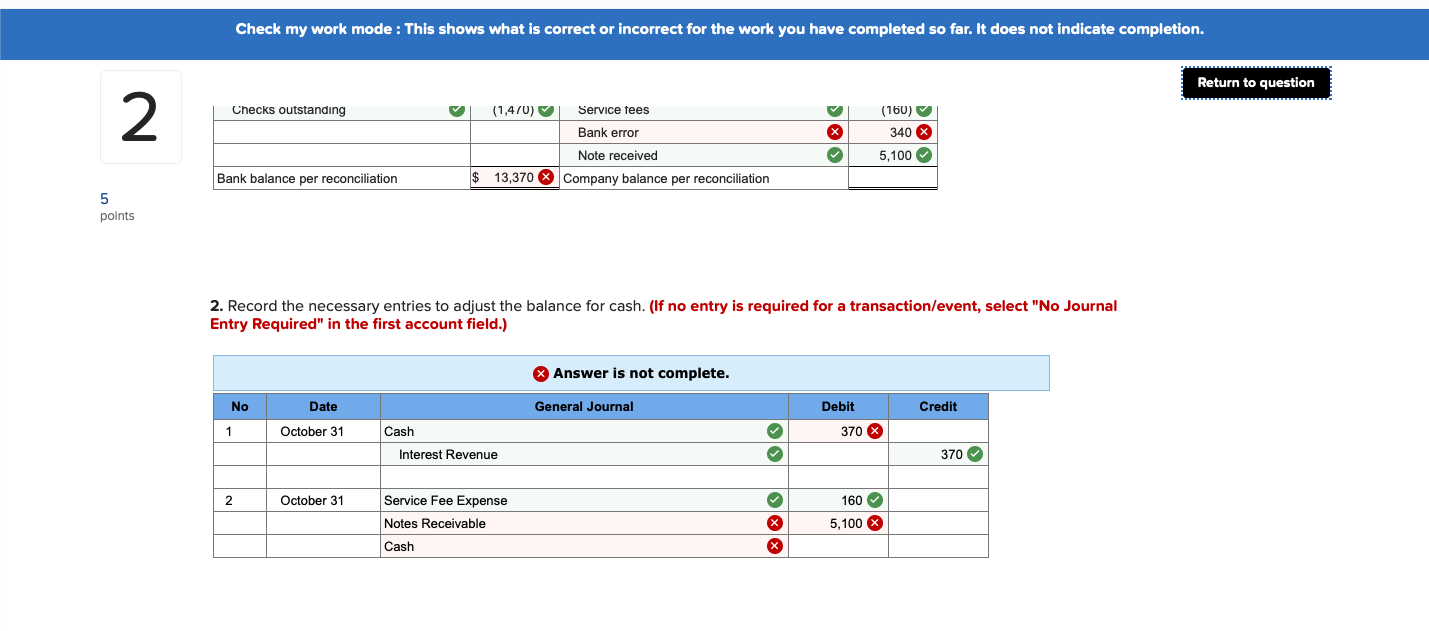

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 2 On October 31, Year 1, A company general ledger shows a checking account balance of $8,400. The company's cash receipts for the month total $74,340, of which $71,300 has been deposited in the bank. In addition, the company has written checks for $72,470, of which $71,000 has been processed by the bank. 5 points The bank statement reveals an ending balance of $11,800 and includes the following items not yet recorded by the company: bank service fees of $160, note receivable collected by the bank of $5,100, and interest earned on the account balance plus from the note of $370. After closer inspection, the company realizes that the bank incorrectly charged the company's account $340 for an automatic withdrawal that should have been charged to another customer's account. The bank agrees to the error. Required: 1. Prepare a bank reconciliation to calculate the correct ending balance of cash on October 31, Year 1. (Amounts to be deducted should be indicated with a minus sign.) Answer is not complete. Bank's Cash Balance Per bank statement Deposits outstanding Checks outstanding Bank Reconciliation October 31, Year 1 Company's Cash Balance $ 11,800 Per general ledger 3,040 Interest earned (1,470) Service fees Bank error Note received $ 13,370 Company balance per reconciliation oool 8,400 370 (160) 340 X 5,100 x Bank balance per reconciliation Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question Checks outstanding 2 (160) x 340 X (1,470) Service tees Bank error Note received $ 13,370 Company balance per reconciliation 5,100 Bank balance per reconciliation 5 points 2. Record the necessary entries to adjust the balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Answer is not complete. No General Journal Debit Credit Date October 31 1 Cash 370 X Interest Revenue 370 2 October 31 160 Service Fee Expense Notes Receivable Cash x 5,100 X x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts