Question: Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

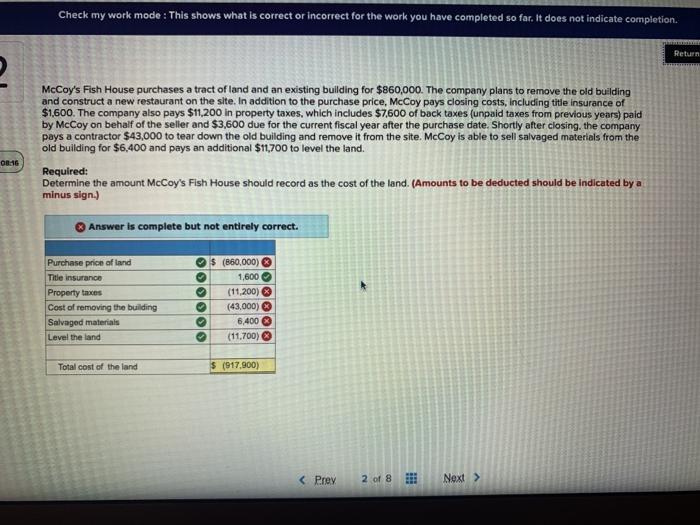

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return McCoy's Fish House purchases a tract of land and an existing building for $860,000. The company plans to remove the old building and construct a new restaurant on the site. In addition to the purchase price, McCoy pays closing costs, including title insurance of $1,600. The company also pays $11,200 in property taxes, which includes $7,600 of back taxes (unpaid taxes from previous years) paid by McCoy on behalf of the seller and $3,600 due for the current fiscal year after the purchase date. Shortly after closing the company pays a contractor $43,000 to tear down the old building and remove it from the site. McCoy is able to sell salvaged materials from the old building for $6,400 and pays an additional $11,700 to level the land. Required: Determine the amount McCoy's Fish House should record as the cost of the land. (Amounts to be deducted should be indicated by a minus sign.) 08:16 Answer is complete but not entirely correct. Purchase price of land Title insurance Property taxes Cost of removing the building Salvaged materials Level the land OOOOO $ (860,000) 1,600 (11,200) (43,000) 6,400 (11.700) Total cost of the land $ (917,900)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts