Question: Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

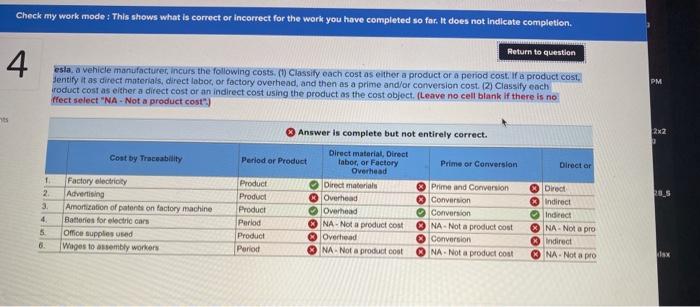

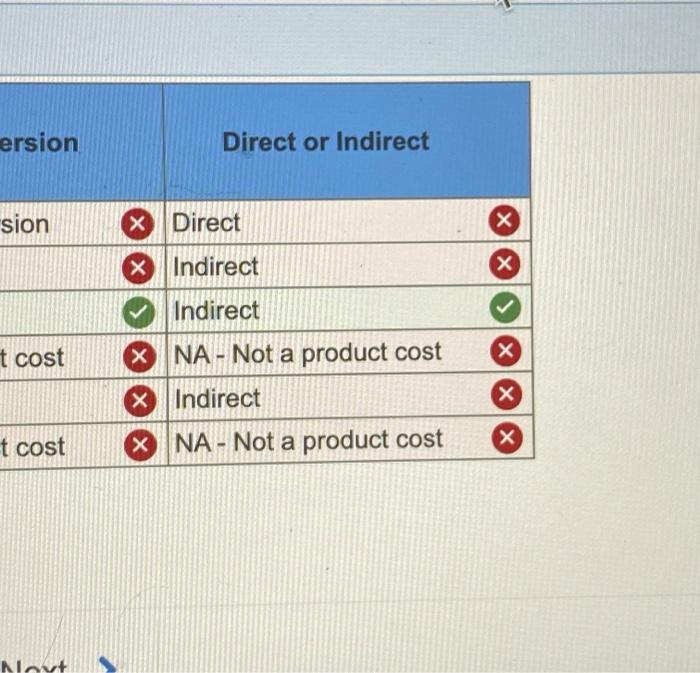

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 4 esla, a vehicle manufacturer incurs the following costs. (1) Classily each cost as either a product or a period cost product cost, Jentity it as direct materials, direct labor, or factory overhead, and then as a prime and/or conversion cost (2) Classify each roduct cost as either a direct cost or an indirect cost using the product as the cost object. (Leave no cell blank if there is no ffect select "NA - Not a product cost) PM ts 2x2 Cost by Traceability Director 1 Answer is complete but not entirely correct. Direct material, Direct Period or Product tabor, or Factory Prime or Conversion Overhead Product Direct materials Prime and Conversion Product Overhead Conversion Product Overhead Conversion Period NA- Not a product cost NA- Not a product cost Product Overhead Conversion Period NA.Not a productos O NA- Not a product cost 2 Factory electricity Advertising Amortization of patents on factory machine Batteries for electric cars Office Supplies used Wages to assembly workers 3. 4 * Direct 3 Indirect Indirect NA - Not a pro Indirect NA- Not a pro 5 6. Alsx ersion Direct or Indirect sion X Direct X X Indirect Indirect t cost X NA - Not a product cost x Indirect X x t cost X NA - Not a product cost Nyt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts