Question: Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate compl

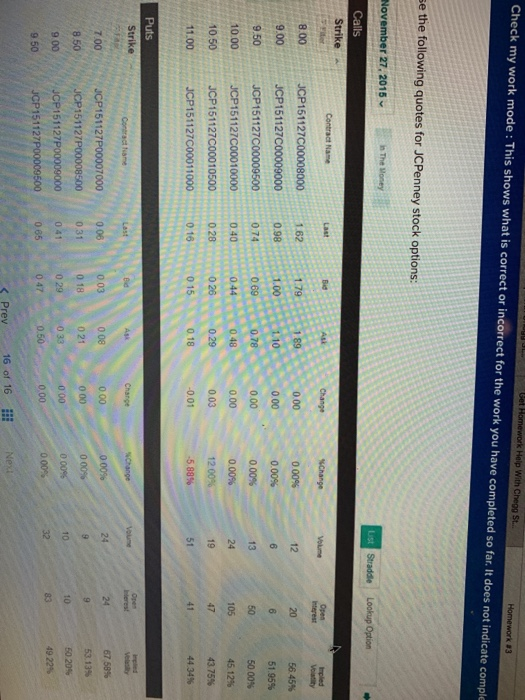

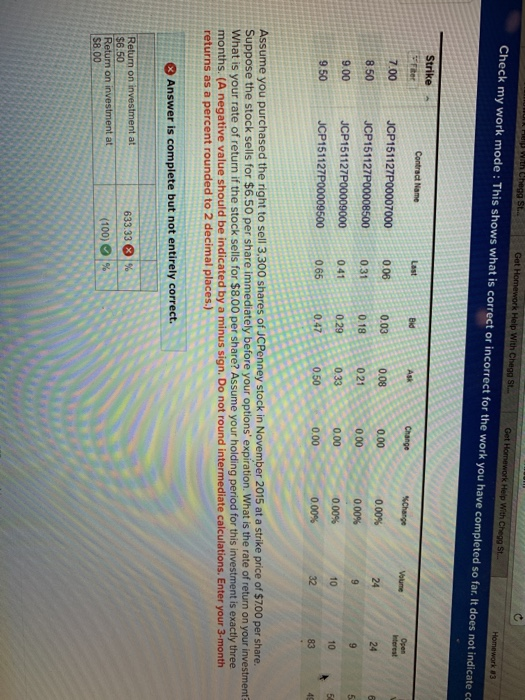

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate compl k#3 se the following quotes for JCPenney stock options: November 27, 2015 List Calls Strike Bid Volume nterest 8.00 9.00 9.50 10.00 10.50 11.00 JCP151127C00008000162179 UCP151127C000090000.981.0 15112700009500 074 JCP151127C00010000 UCP151127C00010500 JCP151127C00011000 000% 000% 0.00% 0.00% 1200% 0.00 12 5645% 51 95% 5000% 45 12% 43. 75% 44.34% 0.00 0 69 0.44 0 26 0 15 0.78 0 48 0 29 0.18 13 24 19 51 105 47 41 0.40 0.00 0 16 0.01 Iterest Last 6758% 5313% 5020% 4922% 0 08 0.00 000% 24 0 06 15112700007000 JCP151127P0000850003 UCP151127P00009000 7 00 8.50 0 33 0:00 0.50 9 50 Prev 16 of 16 ar k Help With Chegg St. Check my work mode : This shows what is correct or incorrect for the work you have completed so far. it does not indicate co St. #3 Strike Contract Name Last eid Interest JCP151127P000070000.080.030.08 0.31 0.18 021 900 JCP151127P00009000 041029 033 0.47,-0.50 7.00 0.00 0.00 0.00 000 0.00% 000% 000% .--000% 8.50 JCP151127P00008500 950 JCP151127P00009500 065 Assume you purchased the right to sell 3,300 shares of JCPenney stock in November 2015 at a strike price of $7.00 per share. Suppose the stock sells for $6.50 per share immediately before your options' expiration. What is the rate of return on your investment? What is your rate of return if the stock sells for $8.00 per share? Assume your holding period for this investment is exactly three months. (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your 3-month returns as a percent rounded to 2 decimal places.) Return on investment at $6.50 633 33 1% n on $8.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts