Question: Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completic

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completic

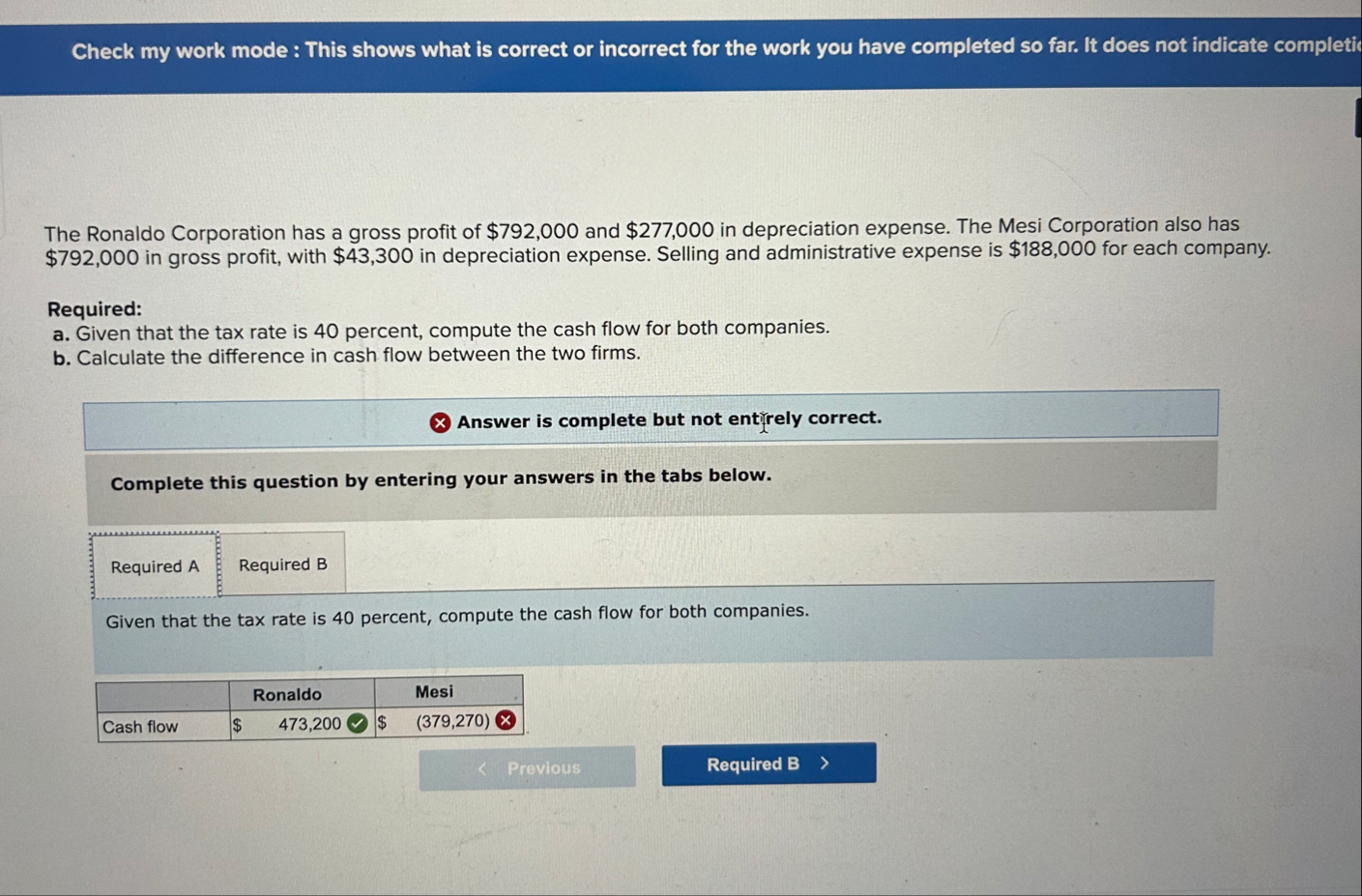

The Ronaldo Corporation has a gross profit of $ and $ in depreciation expense. The Mesi Corporation also has $ in gross profit, with $ in depreciation expense. Selling and administrative expense is $ for each company.

Required:

a Given that the tax rate is percent, compute the cash flow for both companies.

b Calculate the difference in cash flow between the two firms.

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Given that the tax rate is percent, compute the cash flow for both companies.

tableRonaldo,MesiCash flow,$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock