Question: Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not in QS 9-6

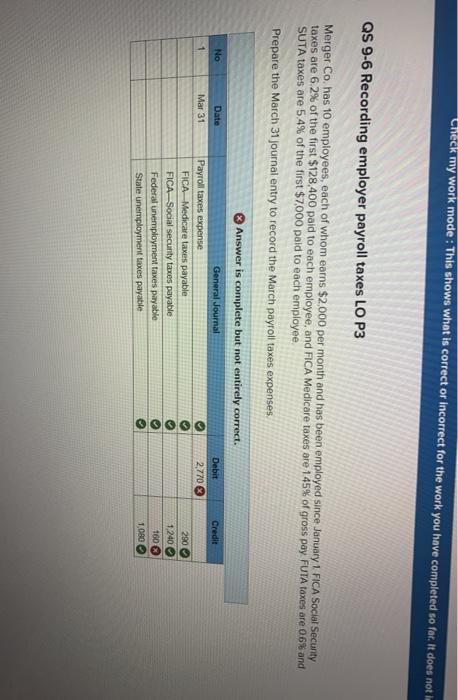

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not in QS 9-6 Recording employer payroll taxes LO P3 Merger Co has 10 employees, each of whom earns $2,000 per month and has been employed since January 1 FICA Social Security taxes are 62% of the first $128.400 paid to each employee, and FICA Medicare taxes are 145% of gross pay FUTA taxes are 06% and SUTA taxes are 5.4% of the first $7,000 paid to each employee Prepare the March 31 journal entry to record the March payroll taxes expenses. Date Credit No 1 Debit 2,770 Mar 31 Answer is complete but not entirely correct. General Journal Payroll taxes expense FICA-Medicare taxes payable FICA-Social security taxes payable Federal unemployment taxes payable State unemployment taxes payable 290 OOOOO 1,240 160 1,080 OOOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts