Question: Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return

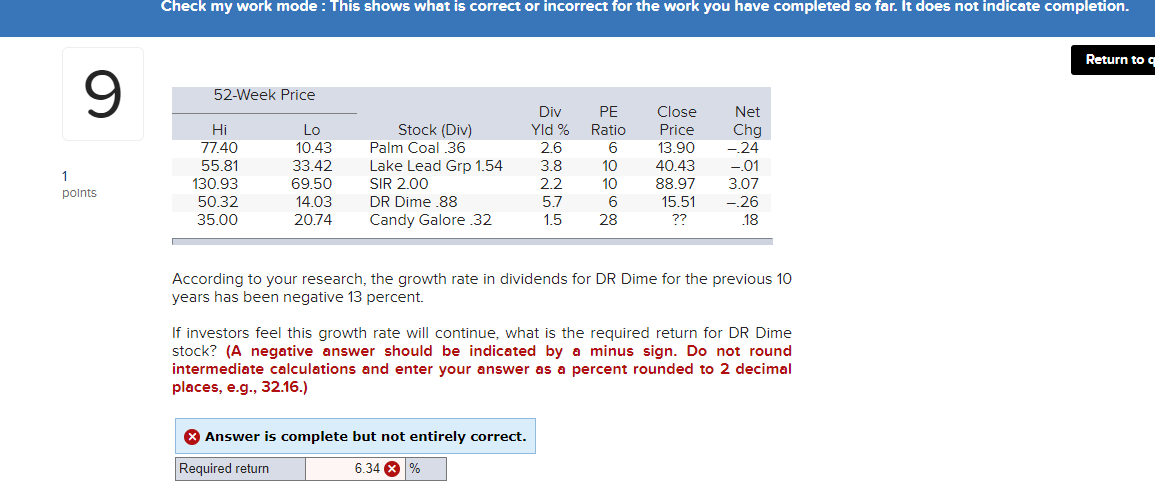

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to a 9 52-Week Price Hi 77.40 55.81 130.93 50.32 35.00 Lo 10.43 33.42 69.50 14.03 20.74 Div Yld % 2.6 3.8 2.2 5.7 1.5 Stock (Div) Palm Coal.36 Lake Lead Grp 1.54 SIR 2.00 DR Dime.88 Candy Galore 32 PE Ratio 6 10 10 6 28 1 points Close Price 13.90 40.43 88.97 15.51 ?? Net Chg -24 -01 3.07 - 26 .18 According to your research, the growth rate in dividends for DR Dime for the previous 10 years has been negative 13 percent. If investors feel this growth rate will continue, what is the required return for DR Dime stock? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Required return 6.34 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts