Question: Check my work mode : This shows whet is correct or incorrect for the work you have completed so fer. It does not indicate completion.

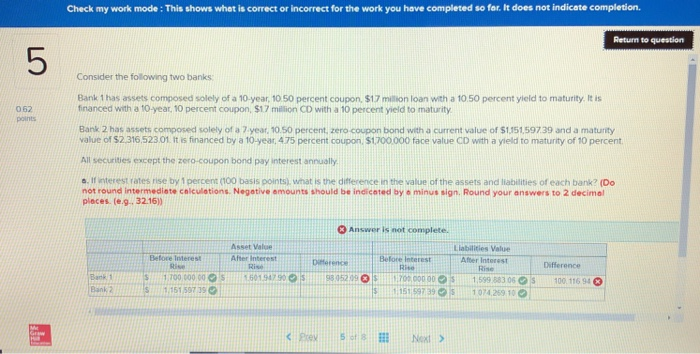

Check my work mode : This shows whet is correct or incorrect for the work you have completed so fer. It does not indicate completion. Return to question 5 Consider the following two banks Bank t has assets composed solely of a 10-year, 10 50 percent coupon, $17 miltion loan with a 10.50 percent yield to maturity, It is financed with a tO-year, 10 percent coupon, $17 million CD with a 10 percent yield to maturity 062 Bank 2 has assets composed solely of a 7 year, 10.50 percent, zero-coupon bond with a current value of $1,15159739 and a maturity value of $2316.523 01 It is financed by a 10-year. 475 percent coupon, s1700000 face value CD with a yield to maturity of 10 percent All securities except the zero-coupon bond pay interest annually o. If interest rates rise by 1 percent (100 basis points), what is the difference in the value of the assets and liabilities of each bank? (Do not round intermediate cnlculations. Negotive amounts should be indicated by & minus sign. Round your answers to 2 decimal ploces. (e.g. 3216)) Asset Vale Liabilities Value After Intorest Before InterestAfter Interest e Interest Difference Rise 1 700 000 00 S501.94790 OS98 0520 3.0 00 1599 883 06s 100 116 94 1.151 597 39 Bank 2 15119739 074 259 10 Prels

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts