Question: Check my work modu This shows what is correct or incorrect for the work you have completed so far I does not indicate comotation. Heturn

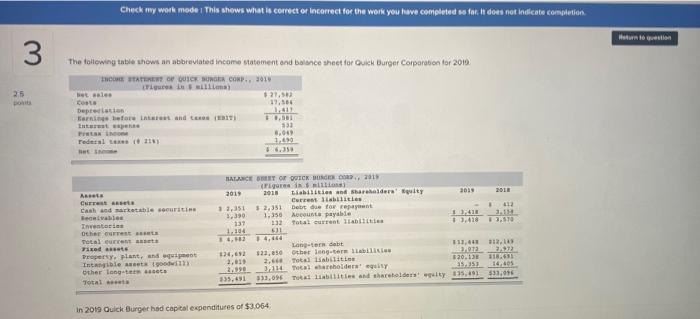

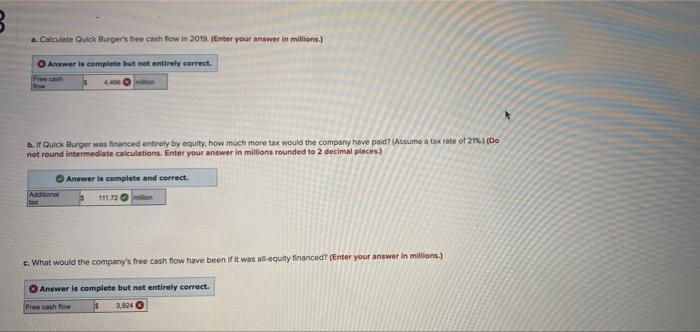

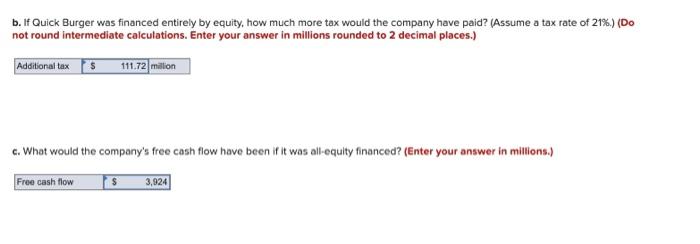

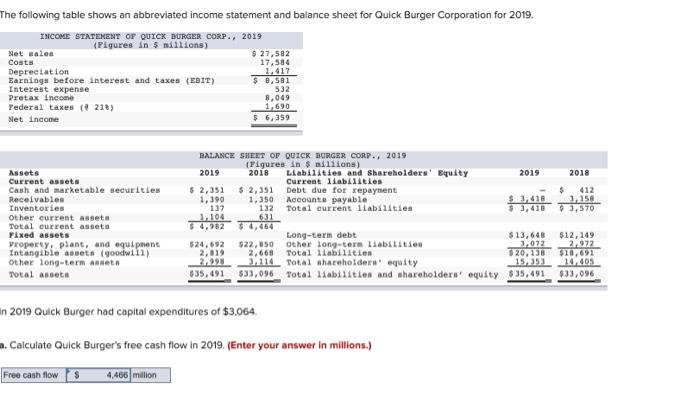

Check my work modu This shows what is correct or incorrect for the work you have completed so far I does not indicate comotation. Heturn to ton 3 The following table snow an abbreviated Income statement and balance sheet for Quick Burger Corporation for 2019 TO OUR SURGER CORP. Ti silma 25 Depression before and IT PL Federal (115) 2. 19.554 1.411 533 8.04 1,490 36.35 A Current Cashodaketable securities Receive Inventories Other current notale Fixed assets Property, plant, and went Intangible aussi other langs Total BALANCE IT OR QUICKBONERO, 2011 Pro 2017 2013 Liabilities and shareholdere 2015 2018 Current Bilities 13.351 3 2,351 Det due torrent . 413 5.399 1.350 As payable 137 132 Total current 1.418 3,570 1.104 1.3.182 4,464 Longer dat 113. 312,1 134,62 323,50 Other long-term bli DO 2972 2,011 2. Total abilities 120.13 BGN 3,114 Total shareholders in 3512 14.05 335.691 333.086 Total liabilities and the elders wity 335.491533016 in 2019 Quick Burget had capital expenditures of $3.064 a. Calculate Quick Burgers free cathrow in 2019. Enter your answer in millions.) Anwwer is complete but not entirely correct. Free cab 40 b. f Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 27%) (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Answer is complete and correct. Additional ta 1172 c. What would the company's free cash flow have been if it was all-equity financed? (Enter your answer in millions.) Answer is complete but not entirely correct. Free how 3.924 b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.) (DO not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Additional tax 15 111.72 million c. What would the company's free cash flow have been if it was all-equity financed? (Enter your answer in millions.) Free cash flow IS 3,924 The following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2019. INCOME STATEMENT OF QUICK BURGER CORP., 2019 Pigures in 6 millions) Net sales $ 27,582 Costs 17,584 Depreciation 1.417 Earnings before interest and taxes (EBIT) $ 8,581 Interest expense 532 Pretax income 8,049 Federal taxes (218) 1,690 Net Income $ 6,359 2019 Assets Current assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Fixed assets Property, plant, and equipment Intangible and goodwill) Other long-term leta Total assets BALANCE SHEET OF QUICK BURGER CORP., 2019 (Figures in 5 millions) 2018 Liabilities and shareholders' Equity 2019 2018 Current liabilities $ 2,351 $ 2,351 Debt due for repayment $ 412 1.390 1,350 Accounts payable $1,610 3,150 137 132 Total current liabilities $ 3,410 $3,570 1. 104 621 5.4,902 4,464 Long-term debt $13,648 $12,149 524,692 $22,050 other long-term liabilities 31,072 2.972 2,019 2,668 Total liabilities 320,30 $10,691 2,298 3,114 Total shareholders' equity 15353 14,405 $35,491 $33,096 Total abilities and shareholders' equity $35,091 $33,096 in 2019 Quick Burger had capital expenditures of $3,064 Calculate Quick Burger's free cash flow in 2019. (Enter your answer in millions.) Free cash flows 4,466 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts