Question: Check my work Problem 10-61 (LO 10-2, LO 10-3) zints Chaz Corporation has taxable income in 2019 of $368,000 for purposes of computing the $179

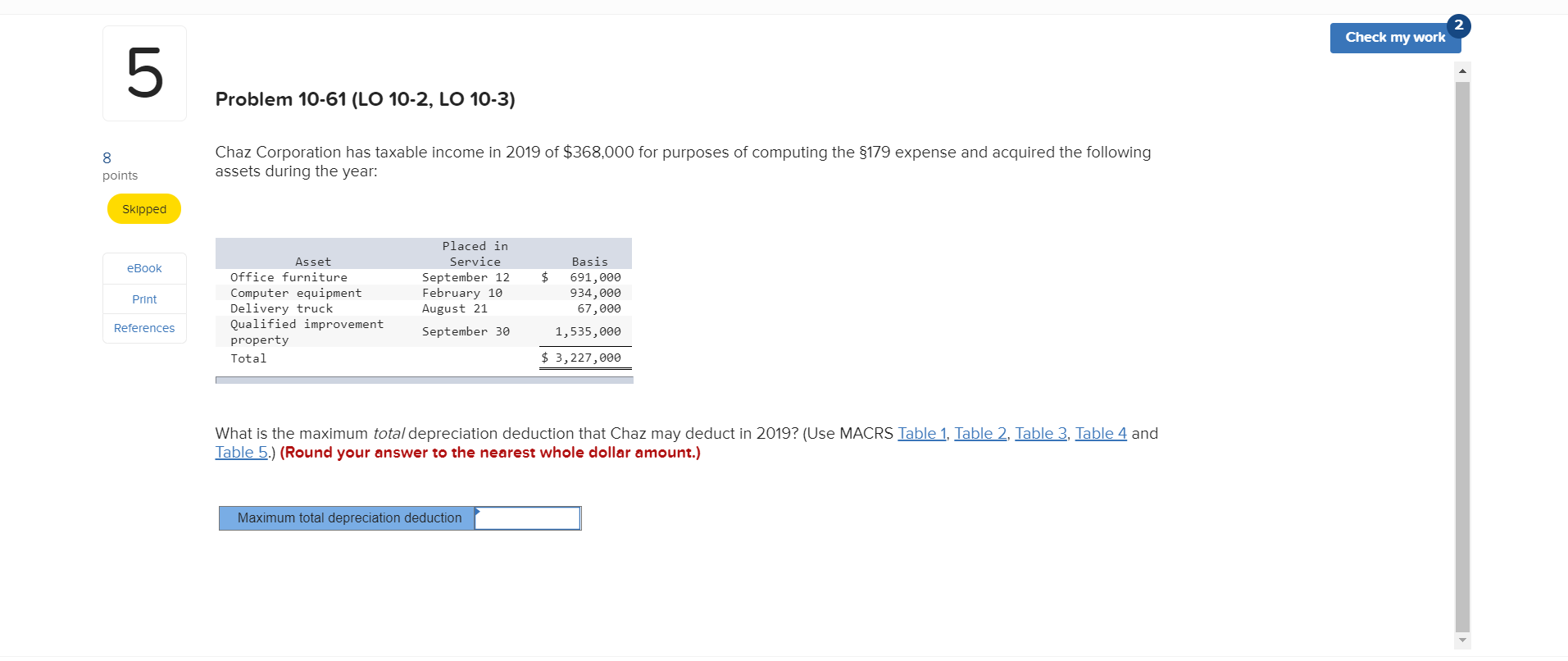

Check my work Problem 10-61 (LO 10-2, LO 10-3) zints Chaz Corporation has taxable income in 2019 of $368,000 for purposes of computing the $179 expense and acquired the following assets during the year: points Skipped eBook Placed in Service September 12 February 10 August 21 September 30 Asset Office furniture Computer equipment Delivery truck Qualified improvement property Total Print Basis $ 691,000 934,000 67,000 1 ,535,000 $ 3,227,000 References What is the maximum total depreciation deduction that Chaz may deduct in 2019? (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Round your answer to the nearest whole dollar amount.) Maximum total depreciation deduction Check my work Problem 10-61 (LO 10-2, LO 10-3) zints Chaz Corporation has taxable income in 2019 of $368,000 for purposes of computing the $179 expense and acquired the following assets during the year: points Skipped eBook Placed in Service September 12 February 10 August 21 September 30 Asset Office furniture Computer equipment Delivery truck Qualified improvement property Total Print Basis $ 691,000 934,000 67,000 1 ,535,000 $ 3,227,000 References What is the maximum total depreciation deduction that Chaz may deduct in 2019? (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Round your answer to the nearest whole dollar amount.) Maximum total depreciation deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts