Question: Check my work Problem 9-2A Entries for payroll transactions LO P2, P3 On January 8, the end of the first weekly pay period of the

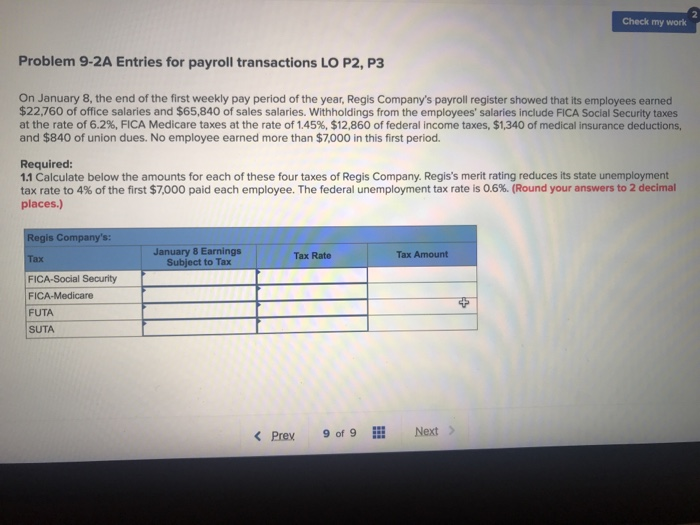

Check my work Problem 9-2A Entries for payroll transactions LO P2, P3 On January 8, the end of the first weekly pay period of the year, Regis Company's payroll register showed that its employees earned $22,760 of office salaries and $65,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $12,860 of federal income taxes, $1,340 of medical insurance deductions, and $840 of union dues. No employee earned more than $7,000 in this first period. Required 1.1 Calculate below the amounts for each of these four taxes of Regis Company. Regis's merit rating reduces its state unemployment tax rate to 4% ofthe first $7,000 paid each employee. The federal unemployment tax rate is 0.6%. (Round your answers to 2 decimal places.) Regis Company's January 8 Earnings Subject to Tax Tax Rate Tax Amount FICA-Social Security FICA-Medicare FUTA SUTA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts