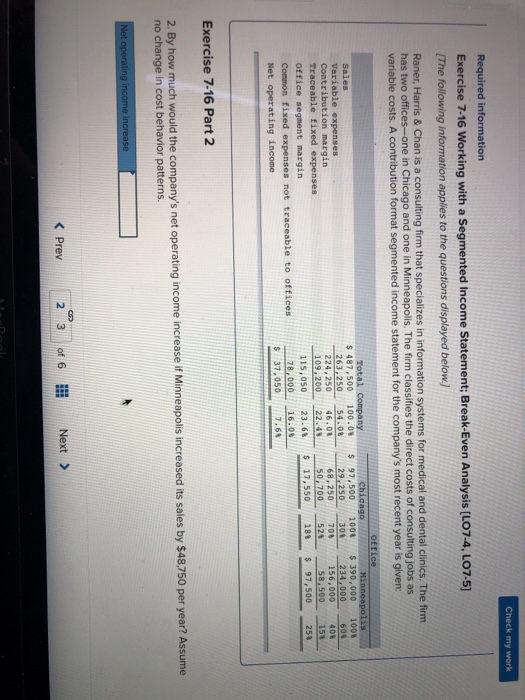

Question: Check my work Required information Exercise 7-16 Working with a Segmented Income Statement; Break-Even Analysis (LO7-4, LO7-5] The following information applies to the questions displayed

![Income Statement; Break-Even Analysis (LO7-4, LO7-5] The following information applies to the](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66db9ca65560a_51766db9ca5a8057.jpg)

Check my work Required information Exercise 7-16 Working with a Segmented Income Statement; Break-Even Analysis (LO7-4, LO7-5] The following information applies to the questions displayed below.) Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Chicago s487 ,500 100.0' s 97,500 100t $390,000 1001 234,000 604 408 58.500 151 Sales Variable expenses Contribution margin 29,250 30% 263,250 54.0868250 70 156,000 529 50,700 109,200 22.4% le fixed expenses 17,550 18% $97,500 25% 115,050 23.6% 5 office segment margin Common fixed expenses not traceable to officesz8/00016.08 $ 37,050 Net operating income Exercise 7-16 Part 2 2. By how much would the company's net operating income increase tf Minneapolis increased ts sales by $48,750 per year? Assume no change in cost behavior patterns. ng 3. Assume that sales in Chicago increase by $32,500 next year and that sales in Minneapolis remain unchanged. Assume no change in fixed costs. a. Prepare a new segmented income statement for the company. (Round your percentage answers to 1 decimal place (i.e. 0.1234 should be entered as 12.3).) Chicago Minneapolis Amount Amount Amount 0.0 0.0 0.0 0.0 0.0 $ 0.0 $ 0.0 MacBook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts