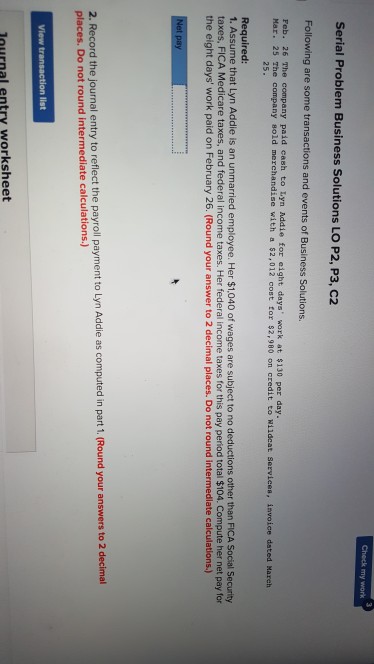

Question: Check my work Serial Problem Business Solutions LO P2, P3, C2 Following are some transactions and events of Business Solutions. Feb. 26 The company paid

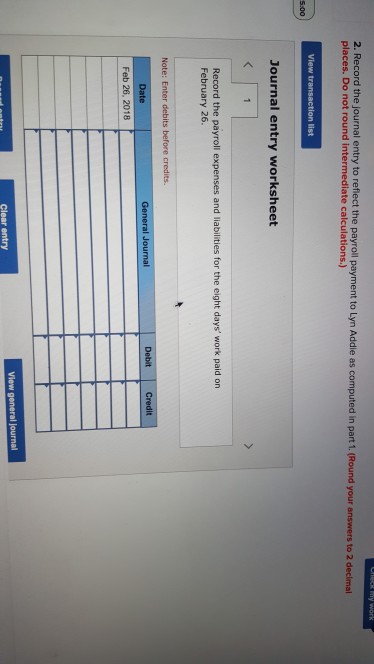

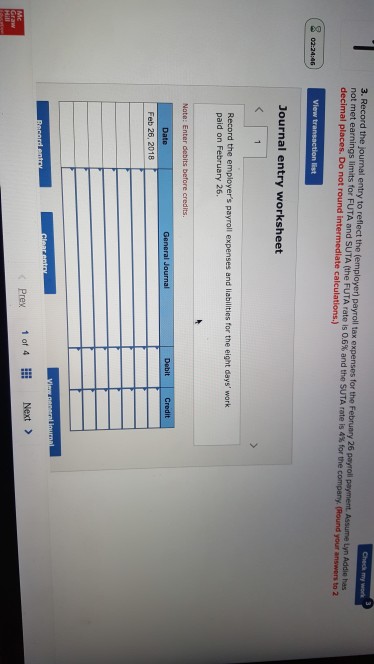

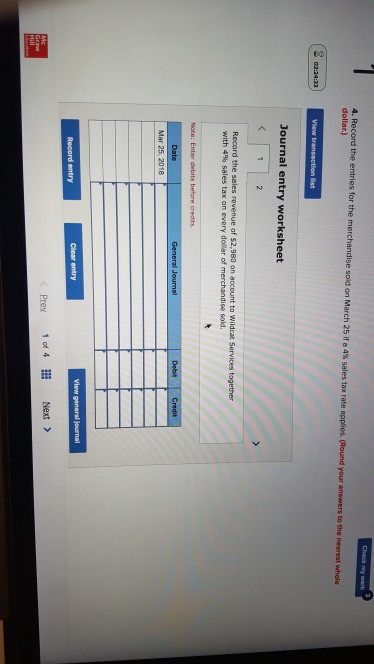

Check my work Serial Problem Business Solutions LO P2, P3, C2 Following are some transactions and events of Business Solutions. Feb. 26 The company paid cash to Lyn Addie for ei company 8old merchandise with a 2,012 cost for $2,980 on credit to ildcat services , invoice dated Hareh 25. Required 1. Assume that Lyn Addie is an unmarried employee. Her $1,040 of wages are subject to no deductions other than FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $104. Compute her net pay for the eight days' work paid on February 26. (Round your answer to 2 decimal places. Do not round intermedlate calculations.) 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. (Round your answers to 2 decimal places. Do not round intermediate calculations.) View on list ournal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts