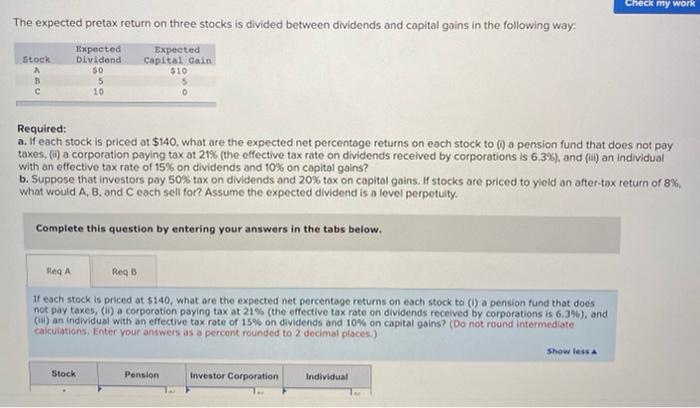

Question: Check my work The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock A 3 Expected

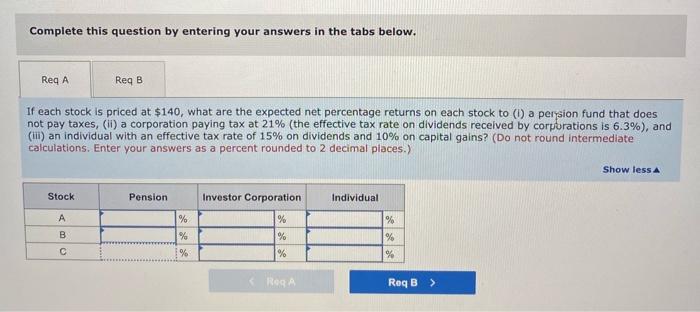

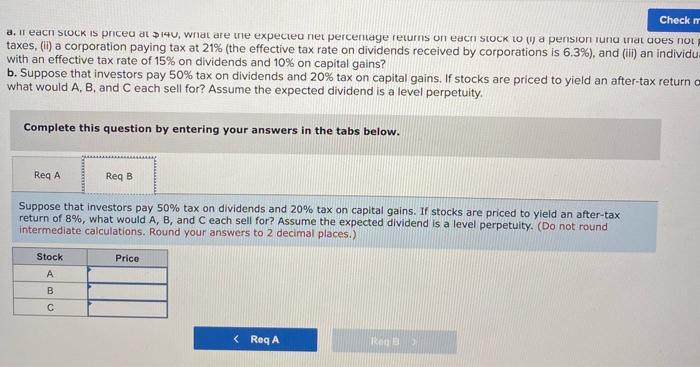

Check my work The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock A 3 Expected Dividend SO 5 10 Expected Capital Gain 510 5 o Required: a. If each stock is priced at $140, what are the expected net percentage returns on each stock to (1) a pension fund that does not pay taxes. () a corporation paying tax ot 21% (the effective tax rate on dividends received by corporations is 6.3%), and (ii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains? b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield on after tax return of 8% what would A, B, and each sell for? Assume the expected dividend is a level perpetuity. Complete this question by entering your answers in the tabs below. Reg A Reg B If each stock is priced at $140, what are the expected net percentage returns on each stock to (1) a pension fund that does not pay taxes, (1) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (II) an individual with an effective tox rate of 15% on dividends and 10% on capital gains? (Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Show less Stock Pension Investor Corporation Individual Complete this question by entering your answers in the tabs below. Req A ReqB If each stock is priced at $140, what are the expected net percentage returns on each stock to (1) a persion fund that does not pay taxes, (i) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (II) an individual with an effective tax rate of 15% on dividends and 10% on capital gains? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Show less Stock Pension Investor Corporation Individual A % % % % % B % % % C % Rega RoqB > Check a. Il each scOCK IS pnced at $140, wnat are the expectea net percentage returns on each stOCK to w a pension luna mat uves nou taxes, (b) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (i) an individu with an effective tax rate of 15% on dividends and 10% on capital gains? b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return what would A, B, and each sell for? Assume the expected dividend is a level perpetuity. Complete this question by entering your answers in the tabs below. Req A Req B Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of 8%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Stock Price A B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts