Question: Check my work View pri Brief Exercise 10-3 Lump-sum acquisition (LO10-2) 12.5 Fullerton Waste Management purchased land and a warehouse for $710,000. In addition to

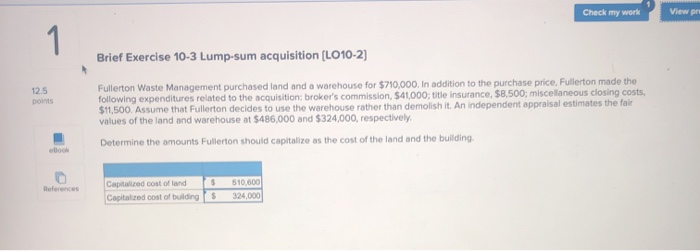

Check my work View pri Brief Exercise 10-3 Lump-sum acquisition (LO10-2) 12.5 Fullerton Waste Management purchased land and a warehouse for $710,000. In addition to the purchase price. Fullerton made the following expenditures related to the acquisition: broker's commission, $41,000 title insurance, $8,500; miscellaneous closing costs, $11,500. Assume that Fullerton decides to use the warehouse rather than demolish it. An independent appraisal estimates the fair values of the land and warehouse at $486,000 and $324,000, respectively Determine the amounts Fullerton should capitalize as the cost of the land and the building References Capitalized cost of land $ Capitalized cost of buildings 510,000 324,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts