Question: Check my workCheck My Work button is now enabled Item 1 Item 1 10 points On June 1, 2020, Shebandowan Investors Inc. issued a $4,870,000,

Check my workCheck My Work button is now enabled

Item 1

Item 1 10 points

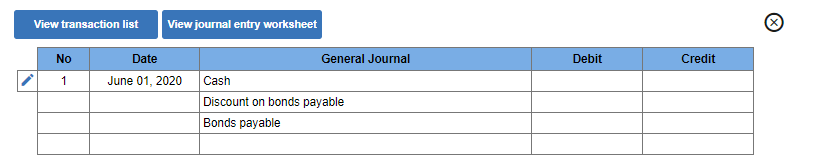

On June 1, 2020, Shebandowan Investors Inc. issued a $4,870,000, 12%, three-year bond. Interest is to be paid semiannually beginning December 1, 2020. Assume that the market rate of interest is 13%. Use TABLE 14A.1 and TABLE 14A.2. (Use appropriate factor(s) from the tables provided.) Required: Part 1 Record the following entries: (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) a. Issuance of the bonds on June 1, 2020 b. Payment of interest on December 1, 2020 c. Adjusting entry to accrue bond interest and discount amortization on January 31, 2021 d. Payment of interest on June 1, 2021 Assume Shebandowan Investors Inc. has a January 31 year-end.

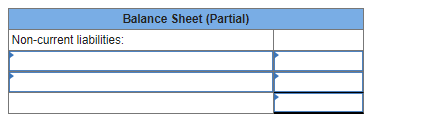

Part 2 Show how the bonds will appear on the balance sheet under non-current liabilities at January 31, 2022. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.)

View transaction list View journal entry worksheet No Debit Credit Date June 01, 2020 1 General Journal Cash Discount on bonds payable Bonds payable Balance Sheet (Partial) Non-current liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts