Question: Check my workCheck My Work button is now enabledItem 5 Suppose that you have $1 million and the following two opportunities from which to construct

Check my workCheck My Work button is now enabledItem 5 Suppose that you have $1 million and the following two opportunities from which to construct a portfolio: Risk-free asset earning 8% per year. Risky asset with expected return of 32% per year and standard deviation of 39%.

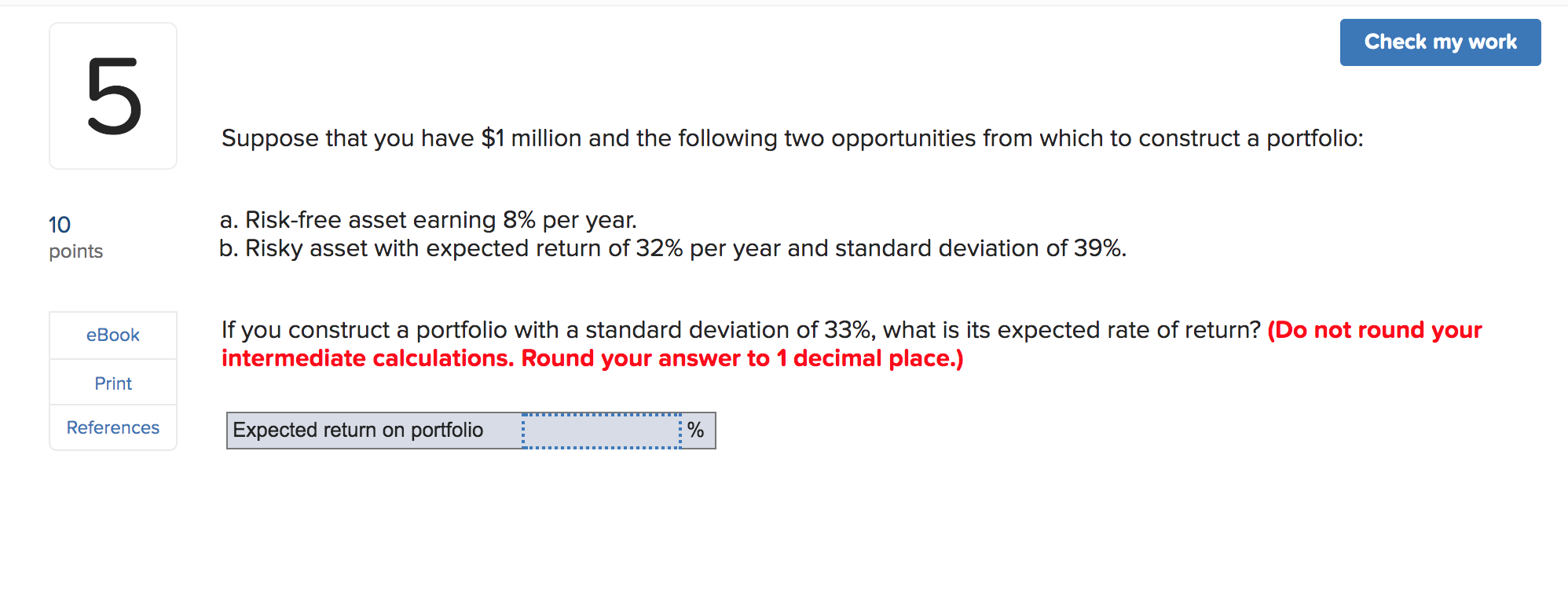

Check my work UT Suppose that you have $1 million and the following two opportunities from which to construct a portfolio: 10 points a. Risk-free asset earning 8% per year. b. Risky asset with expected return of 32% per year and standard deviation of 39%. eBook If you construct a portfolio with a standard deviation of 33%, what is its expected rate of return? (Do not round your intermediate calculations. Round your answer to 1 decimal place.) Print References Expected return on portfolio %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts