Question: Check Problem 12-18 Portfolio Risk and Return (LO2) Suppose that the S&P 500, with a beta of 1.0, has an expected return of 15% and

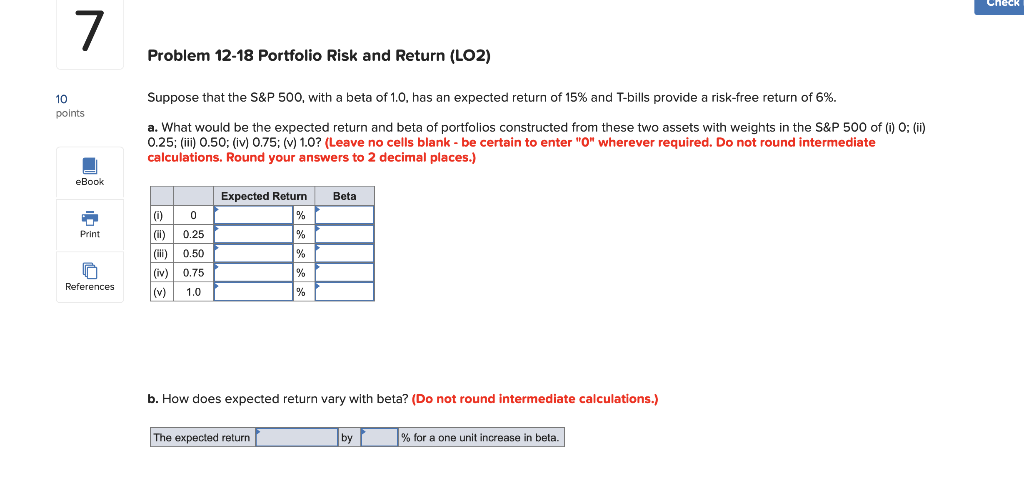

Check Problem 12-18 Portfolio Risk and Return (LO2) Suppose that the S&P 500, with a beta of 1.0, has an expected return of 15% and T-bills provide a risk-free return of 6%. points a. What would be the expected return and beta of portfolios constructed from these two assets with weights in the S&P 500 of (0) O; (ii) 0.25; (iii) 0.50; (iv) 0.75; (v) 1.0? (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) eBook Expected Return Beta Print (0) (I) (ii) (iv) (v) 0 0.25 0.50 0.75 1.0 References b. How does expected return vary with beta? (Do not round Intermediate calculations.) The expected return by % for a one unit increase in beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts