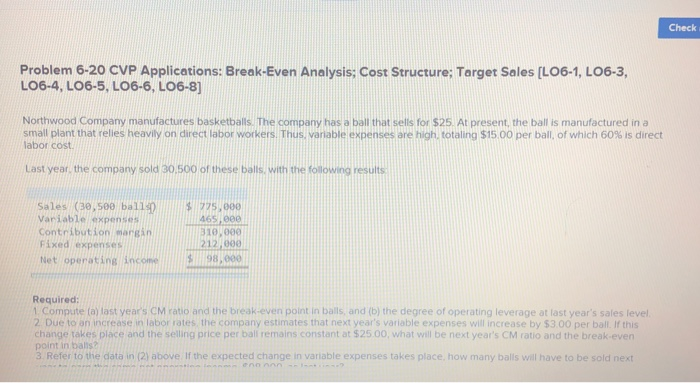

Question: Check Problem 6-20 CVP Applications: Break-Even Analysis; Cost Structure: Target Sales [LO6-1, LO6-3, LO6-4, LO6-5, LO6-6, LO6-8) Northwood Company manufactures basketballs. The company has a

Check Problem 6-20 CVP Applications: Break-Even Analysis; Cost Structure: Target Sales [LO6-1, LO6-3, LO6-4, LO6-5, LO6-6, LO6-8) Northwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball is manufactured in a small plant that relies heavily on direct labor workers. Thus, variable expenses are high, totaling $15.00 per ball, of which 60% is direct labor cost. Last year, the company sold 30,500 of these balls, with the following results Sales (30,500 ba1140 % 775,000 Variable/expenses Contribution000 465,000 Fixed expenses 212 990 Net operating Ancom 98 00 Required: 1 Compute ta) last years CM ratio and the break-even point in balls and (b) the degree of operating leverage at last year's sales level 2 Due to an increase in labor rates, the company estimates that next year's variable expenses change takes place and the selling price per ball remains constant at $25.00, what will be next year's CM ratio and the break will increase by $3 00 per ball. If this t in balts? Refer to the data in (2) above If the expected change in variable expenses takes place, how many balls will have to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts