Question: Check Rolfe Company ( a U . S . - based company ) has a subsidiary in Nigeria, where the local currency unit is the

Check

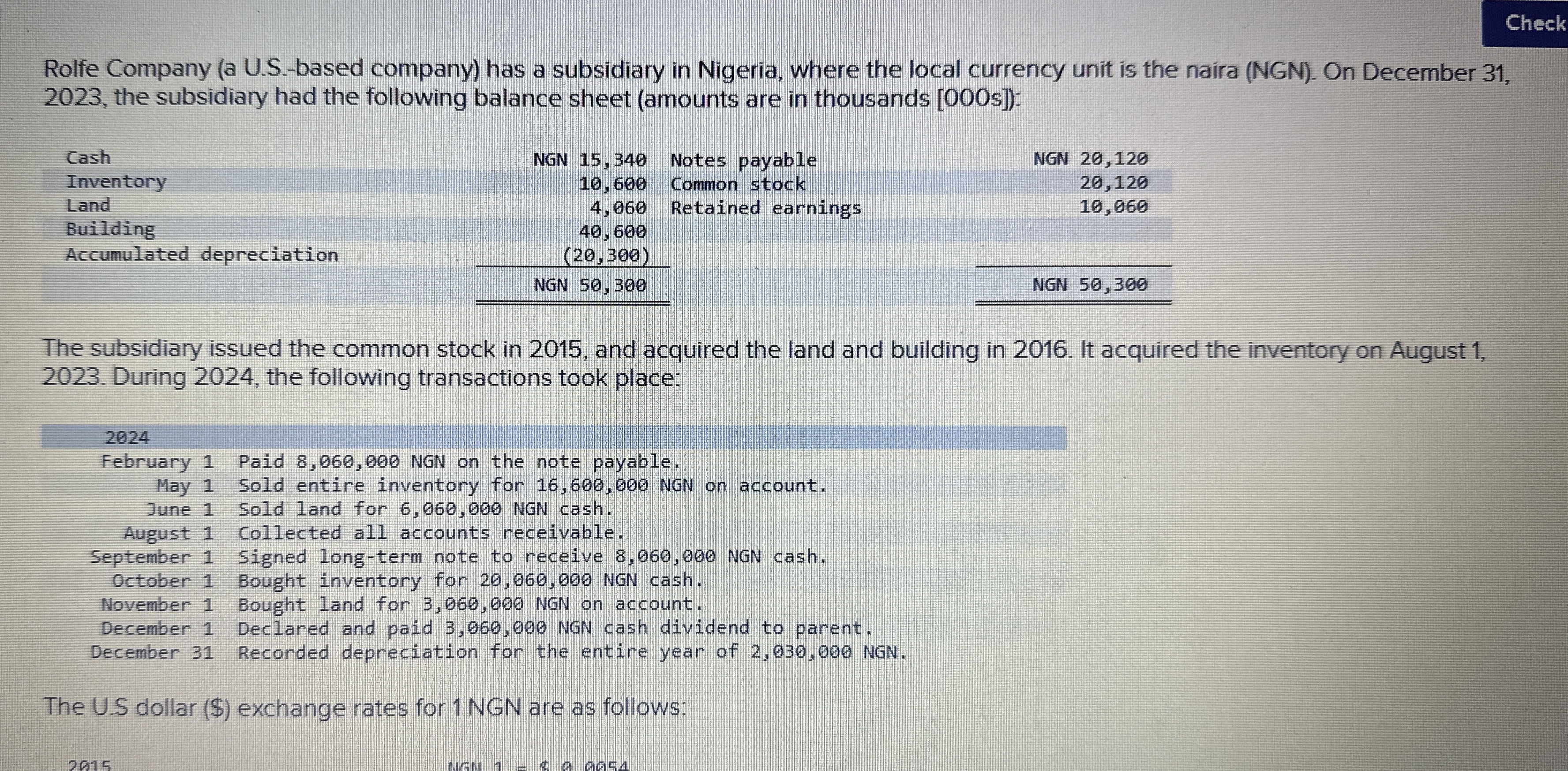

Rolfe Company a USbased company has a subsidiary in Nigeria, where the local currency unit is the naira NGN On December the subsidiary had the following balance sheet amounts are in thousands s:

tableCashNGN InventoryLandBuildingAccumulated depreciation,

The US dollar $ exchange rates for NGN are as follows:

NGN $

NGN

NGN

NGN

NGN

NGN

NGN

NGN

NGN

NGN

NGN

NGN

NGN

NGN

NGN $

NGN

August

December

February

May

June

August

September

October

November

December

December

Average for

Required:

a Assuming the NGN is the subsidiary's functional currency, what is the translation adjustment determined solely for

b Assuming the US dollar is the subsidiary's functional currency, what is the remeasurement gain or loss determined solely for Note: Input all amounts as positive. Enter amounts in whole dollars.

tableaPositive,translation adjustment,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock