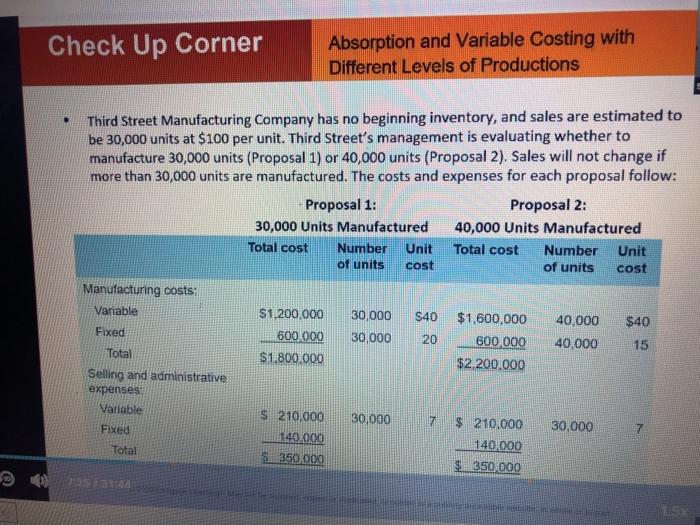

Question: Check Up Corner Absorption and Variable Costing with Different Levels of Productions Third Street Manufacturing Company has no beginning inventory, and sales are estimated to

Check Up Corner Absorption and Variable Costing with Different Levels of Productions Third Street Manufacturing Company has no beginning inventory, and sales are estimated to be 30,000 units at $100 per unit. Third Street's management is evaluating whether to manufacture 30,000 units (Proposal 1) or 40,000 units (Proposal 2). Sales will not change if more than 30,000 units are manufactured. The costs and expenses for each proposal follow: Proposal 1: Proposal 2: 30,000 Units Manufactured 40,000 Units Manufactured Total cost Number Unit Total cost Number Unit of units cost of units cost Manufacturing costs: Variable $1,200,000 30.000 S40 $1,600,000 40,000 $40 Fixed 600 000 30,000 20 600.000 40,000 15 Total $1.800.000 $2,200.000 Selling and administrative expenses Variable S210,000 30.000 7 $ 210,000 30.000 17 Fixed 140.000 140.000 Total S 350 000 $ 350.000 17:05 Check Up Corner Absorption and Variable Costing with Different Levels of Productions a. Prepare an estimated income statement, comparing operating results if 30,000 and 40,000 units are manufactured in (1) the absorption costing format and (2) the variable costing format. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts