Question: Ched Brief Exercise 7-6 (Static) Sales returns (L07-4) During 2021. its first year of operations, Holis Industries recorded sales of $10,600,000 and experienced returns of

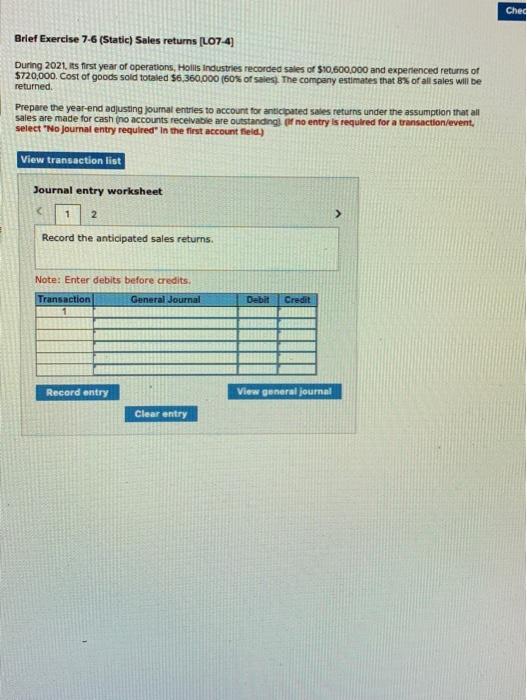

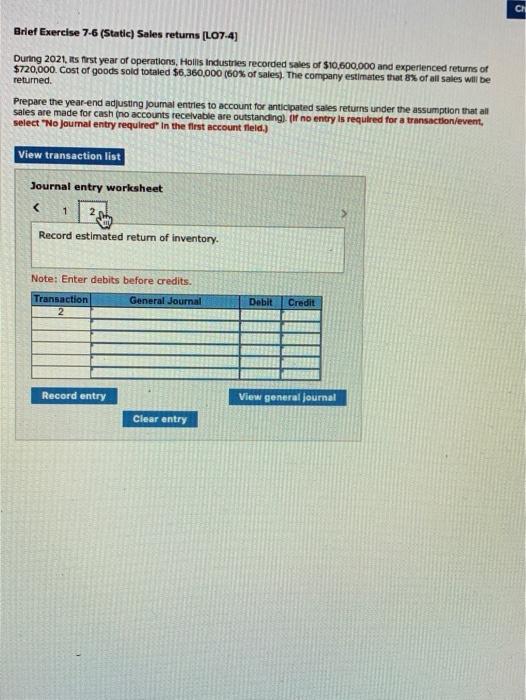

Ched Brief Exercise 7-6 (Static) Sales returns (L07-4) During 2021. its first year of operations, Holis Industries recorded sales of $10,600,000 and experienced returns of $720,000. Cost of goods sold totaled $6,360,000 (60% of sales. The company estimates that 8% of all sales will be returned. Prepare the year-end adjusting journal entries to account for anticipated sales returns under the assumption that all sales are made for cash (no accounts receivable are outstanding of no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 > Record the anticipated sales returns. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry View general journal Clear entry CH Brief Exercise 7-6 (Static) Sales returns (L07-4) During 2021, its first year of operations, Holls Industries recorded sales of $10,600,000 and experienced returns of $720,000. Cost of goods sold totaled $6,360,000 (60% of sales. The company estimates that 8% of all sales will be returned. Prepare the year-end adjusting joumal entries to account for anticipated sales returns under the assumption that all sales are made for cash (no accounts receivable are outstanding (if no entry is required for a transaction/event, select "No Journal entry required in the flest account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts