Question: = Chegg Study Textbook Solutions Expert Q&A Practice ney Po - Price of the stock today D = Dividend at the end of the first

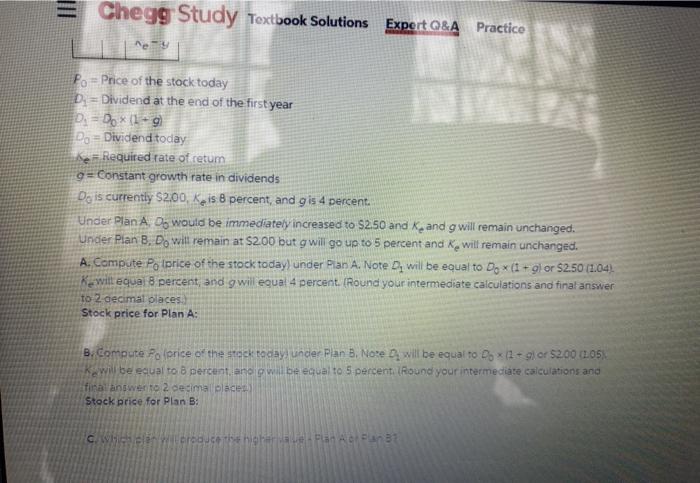

= Chegg Study Textbook Solutions Expert Q&A Practice ney Po - Price of the stock today D = Dividend at the end of the first year D. =Do *(1+9 Do - Dividend today Ker Required rate of retum g=Constant growth rate in dividends Do is currently $200, Kis 8 percent, and gis 4 percent. Under Plan A Os would be immediately increased to $2.50 and K. and g will remain unchanged. Under Plan 8. Do will remain at $2.00 but g will go up to 5 percent and Ke will remain unchanged. A. Compute Polprice of the stock today) under Plan A. Note D will be equal to Do x (1 +1 or $2.50 (1.04. Ke will equal 8 percent, and g will equal 4 percent. (Round your intermediate calculations and final answer to 2 decimal places Stock price for Plan A: B. Compute Folprice of the stock today) under Plan B, Nore will be equal to Do X(1 - 1 or $200 (105) Re Will be equal to 8 percent and will be equal to 5 percent. Round your intermediate calculations and final answer to 2 cedima place Stock price for Plan B: che wireduce the higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts