Question: Cheque Purchase Invoice #FW-04-18 Dated April 2, 2022 From Four Walls Inc., $1 582 for monthly rent, including HST. Paid by cheque #501. Allocate 70%

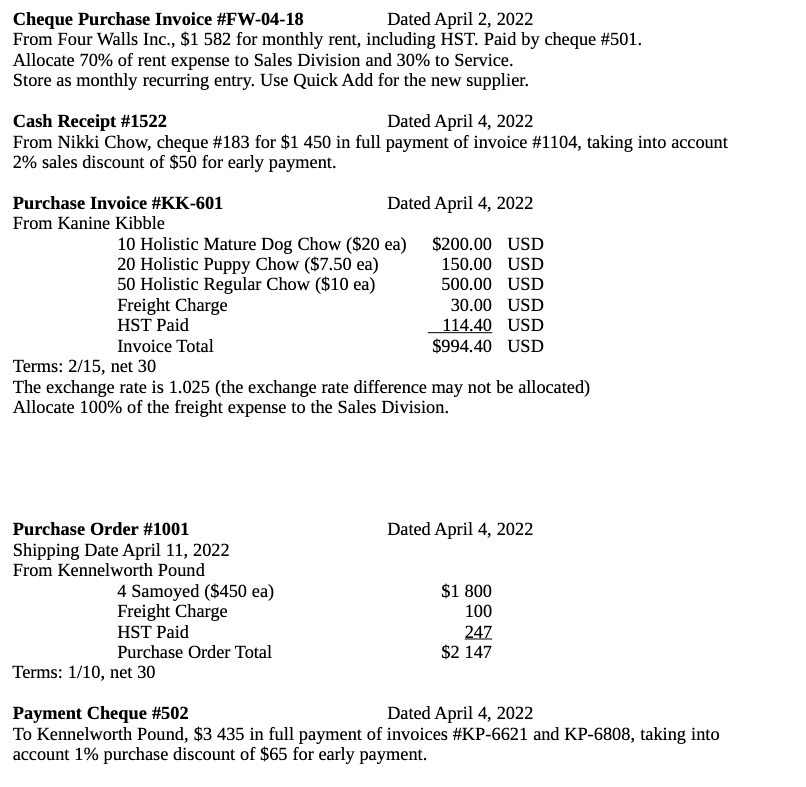

Cheque Purchase Invoice #FW-04-18 Dated April 2, 2022 From Four Walls Inc., $1 582 for monthly rent, including HST. Paid by cheque #501. Allocate 70% of rent expense to Sales Division and 30% to Service. Store as monthly recurring entry. Use Quick Add for the new supplier. Cash Receipt #1522 Dated April 4, 2022 From Nikki Chow, cheque #183 for $1 450 in full payment of invoice #1104, taking into account 2% sales discount of $50 for early payment. Purchase Invoice #KK-601 Dated April 4, 2022 From Kanine Kibble 10 Holistic Mature Dog Chow ($20 ea) $200.00 USD 20 Holistic Puppy Chow ($7.50 ea) 150.00 USD 50 Holistic Regular Chow ($10 ea) 500.00 USD Freight Charge 30.00 USD HST Paid 114.40 USD Invoice Total $994.40 USD Terms: 2/15, net 30 The exchange rate is 1.025 (the exchange rate difference may not be allocated) Allocate 100% of the freight expense to the Sales Division. Purchase Order #1001 Dated April 4, 2022 Shipping Date April 11, 2022 From Kennelworth Pound 4 Samoyed ($450 ea) $1 800 Freight Charge 100 HST Paid 247 Purchase Order Total $2 147 Terms: 1/10, net 30 Payment Cheque #502 Dated April 4, 2022 To Kennelworth Pound, $3 435 in full payment of invoices #KP-6621 and KP-6808, taking into account 1% purchase discount of $65 for early payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts