Question: chern's case study appendix in strategic staffing by philips 3rd edition 11. a. Develop a rational way of combining the scores on the assessment methods

chern's case study appendix in strategic staffing by philips 3rd edition

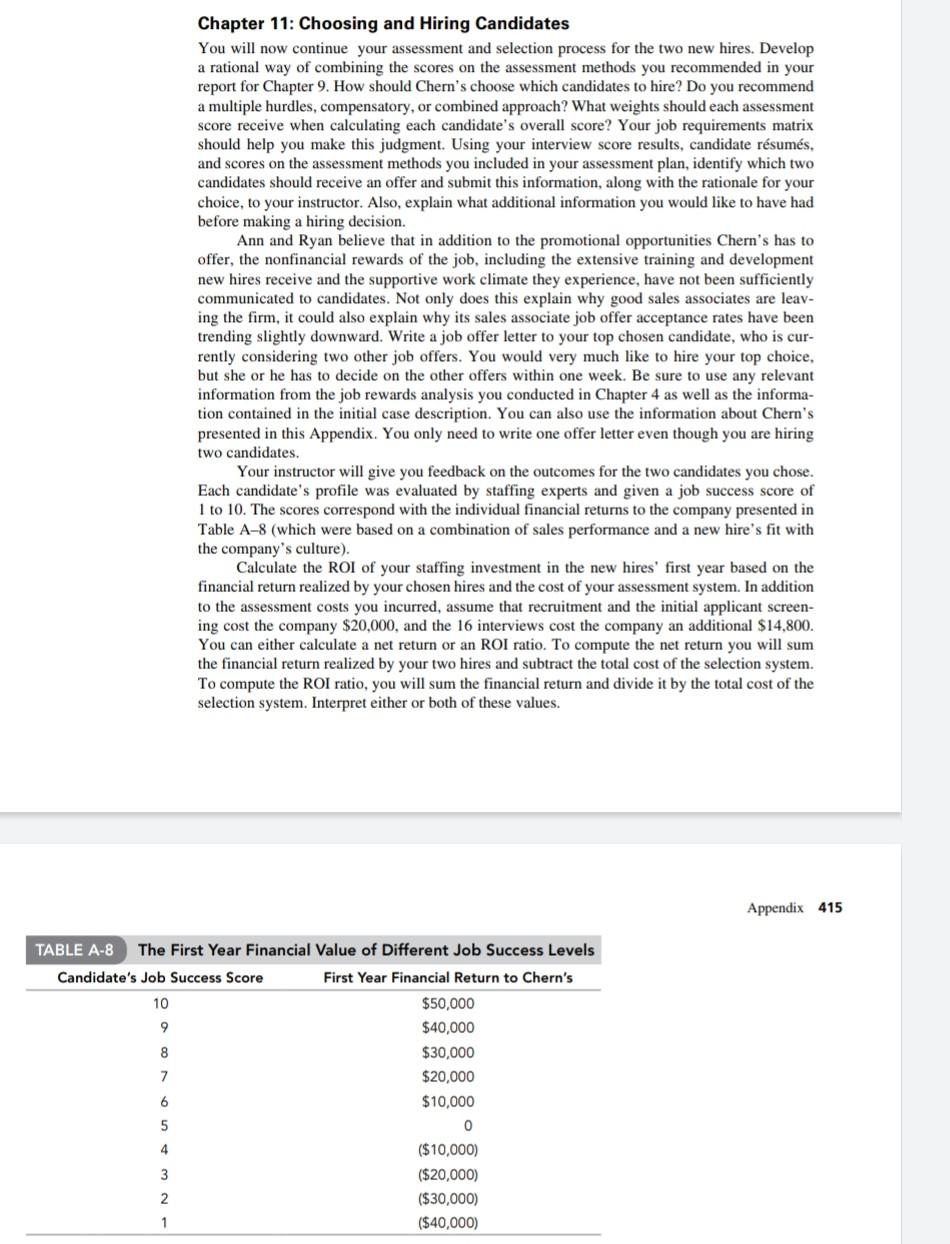

11. a. Develop a rational way of combining the scores on the assessment methods you recom- mended. Recommend either a multiple hurdles, compensatory, or combined approach and explain. b. Describe the weights for each assessment method when calculating the overall score. c. Using your interview score results, candidate rsums, and scores on the assessment methods you included in your assessment plan, identify which two candidates should receive an offer. d. Submit this information along with the rationale for your choices. e. Explain what additional information you would like to have had before making a hiring decision. f. Write a job offer letter to the top candidate of your two chosen hires (you only need to write one letter). g. Receive feedback from your instructor on the outcomes for the candidates you chose. h. Calculate the ROI or net return of your staffing investment for the two people you selected. Interpret the ROI or net return. Chapter 11: Choosing and Hiring Candidates You will now continue your assessment and selection process for the two new hires. Develop a rational way of combining the scores on the assessment methods you recommended in your report for Chapter 9. How should Chern's choose which candidates to hire? Do you recommend a multiple hurdles, compensatory, or combined approach? What weights should each assessment score receive when calculating each candidate's overall score? Your job requirements matrix should help you make this judgment. Using your interview score results, candidate rsums, and scores on the assessment methods you included in your assessment plan, identify which two candidates should receive an offer and submit this information, along with the rationale for your choice to your instructor. Also, explain what additional information you would like to have had before making a hiring decision. Ann and Ryan believe that in addition to the promotional opportunities Chern's has to offer, the nonfinancial rewards of the job, including the extensive training and development new hires receive and the supportive work climate they experience, have not been sufficiently communicated to candidates. Not only does this explain why good sales associates are leav- ing the firm, it could also explain why sales associate job offer acceptance rates have been trending slightly downward. Write a job offer letter to your top chosen candidate, who is cur- rently considering two other job offers. You would very much like to hire your top choice, but she or he has to decide on the other offers within one week. Be sure to use any relevant information from the job rewards analysis you conducted in Chapter 4 as well as the informa- tion contained in the initial case description. You can also use the information about Chern's presented in this Appendix. You only need to write one offer letter even though you are hiring two candidates. Your instructor will give you feedback on the outcomes for the two candidates you chose. Each candidate's profile was evaluated by staffing experts and given a job success score of 1 to 10. The scores correspond with the individual financial returns to the company presented in Table A-8 (which were based on a combination of sales performance and a new hire's fit with the company's culture). Calculate the ROI of your staffing investment in the new hires' first year based on the financial return realized by your chosen hires and the cost of your assessment system. In addition to the assessment costs you incurred, assume that recruitment and the initial applicant screen- ing cost the company $20,000, and the 16 interviews cost the company an additional $14,800. You can either calculate a net return or an ROI ratio. To compute the net return you will sum the financial return realized by your two hires and subtract the total cost of the selection system. To compute the ROI ratio, you will sum the financial return and divide it by the total cost of the selection system. Interpret either or both of these values. Appendix 415 TABLE A-8 The First Year Financial Value of Different Job Success Levels Candidate's Job Success Score First Year Financial Return to Chern's 10 $50,000 9 $40,000 8 $30,000 7 $20,000 6 $10,000 5 0 4 ($10,000) 3 ($20,000) 2 ($30,000) 1 ($40,000)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock