Question: Cherry Cotta makes custom ordered clay pots for residential gardens. Below is cost information regarding its latest job. Cherry cotta makes custom ordered clay pots

Cherry Cotta makes custom ordered clay pots for residential gardens. Below is cost information regarding its latest job. Cherry cotta makes custom ordered clay pots for residential gardens. Below is cost information regarding its latest job.

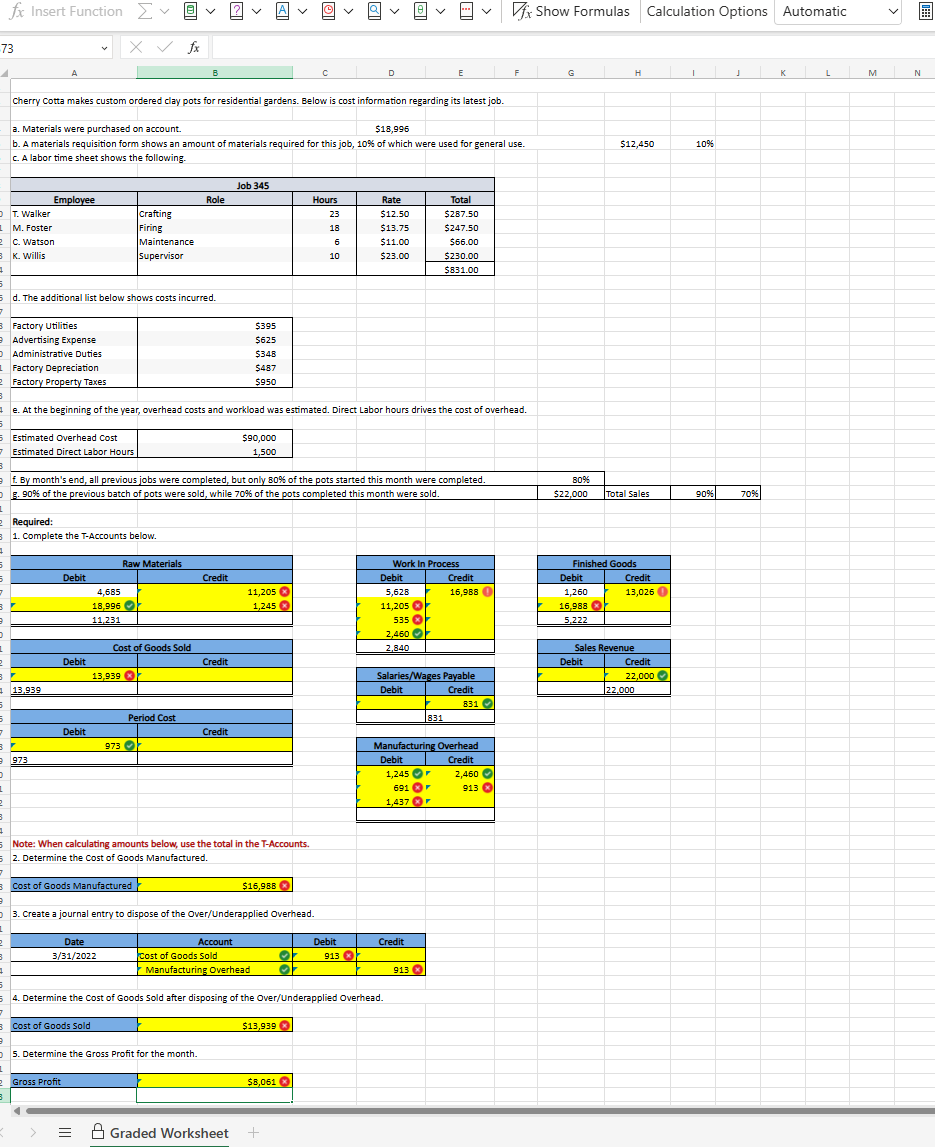

a Materials were purchased on account.

$

b A materials requisition form shows an amount of materials required for this job, of which were used for general use.

c A labor time sheet shows the following.

d The additional list below shows costs incurred.

e At the beginning of the year, overhead costs and workload was estimated. Direct Labor hours drives the cost of overhead.

Required:

Complete the TAccounts below.

Note: When calculating amounts below, use the total in the TAccounts.

Determine the Cost of Goods Manufactured.

Cost of Goods Manufactured

$

Create a journal entry to dispose of the OverUnderapplied Overhead.

Determine the Cost of Goods sold after disposing of the OverUnderapplied Overhead.

Determine the Gross Profit for the month.

a Materials were purchased on account. $

b A materials requisition form shows an amount of materials required for this job, of which were used for general use. $

c A labor time sheet shows the following.

Job

Employee Role Hours Rate Total

T Walker Crafting $ $

M Foster Firing $ $

C Watson Maintenance $ $

K Willis Supervisor $ $

$

d The additional list below shows costs incurred.

Factory Utilities $

Advertising Expense $

Administrative Duties $

Factory Depreciation $

Factory Property Taxes $

e At the beginning of the year, overhead costs and workload was estimated. Direct Labor hours drives the cost of overhead.

Estimated Overhead Cost $

Estimated Direct Labor Hours

f By month's end, all previous jobs were completed, but only of the pots started this month were completed.

g of the previous batch of pots were sold, while of the pots completed this month were sold. $ Total Sales

Required:

Complete the TAccounts below.

Raw Materials Work In Process Finished Goods

Debit Credit Debit Credit Debit Credit

Cost of Goods Sold Sales Revenue

Debit Credit Debit Credit

SalariesWages Payable

Debit Credit

Period Cost

Debit Credit

Manufacturing Overhead

Debit Credit

Note: When calculating amounts below, use the total in the TAccounts.

Determine the Cost of Goods Manufactured.

Cost of Goods Manufactured

Create a journal entry to dispose of the OverUnderapplied Overhead.

Date Account Debit Credit

Determine the Cost of Goods Sold after disposing of the OverUnderapplied Overhead.

Cost of Goods Sold

Determine the Gross Profit for the month.

Gross Profit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock