Question: Cheryl Thoman has recently Joined brooks as Assistant controller, and her first assignment is to prepare the December 3 1 , 2 0 2 5

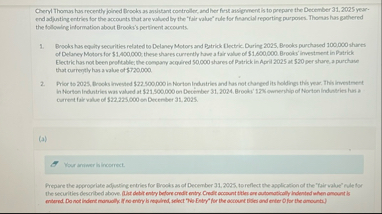

Cheryl Thoman has recently Joined brooks as Assistant controller, and her first assignment is to prepare the December year end adjusting entries for the accounts that are valued by the "Fair value" rule for financial reporting purposes. Thomas has gathered the following information about Brook's pertinent accounts.

Brooks has equity securities related to Delaney Motors and Patrick Electric. During Brooks purchased shares of Delaney Motors for $ these shares currently have a fair value of $ Brook's investment in Patrick Electric has not been profitable; the company acquired shared of Patrick in April at $ per share, a purchase that currently has a value of $

Prior to Brooks invested in Norton industries and has nkt chnaged its holdings this year. This investment In Norton Industries was valued at $ on Devenber Brooks' ownership of Norton industries has a current fair value of $ on Decenber

a

pepare the appropriate adjusting entries for Brooks as of December te reflect the application of the "fair value" rule for the securities described above

Pleaze answer letter a

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock