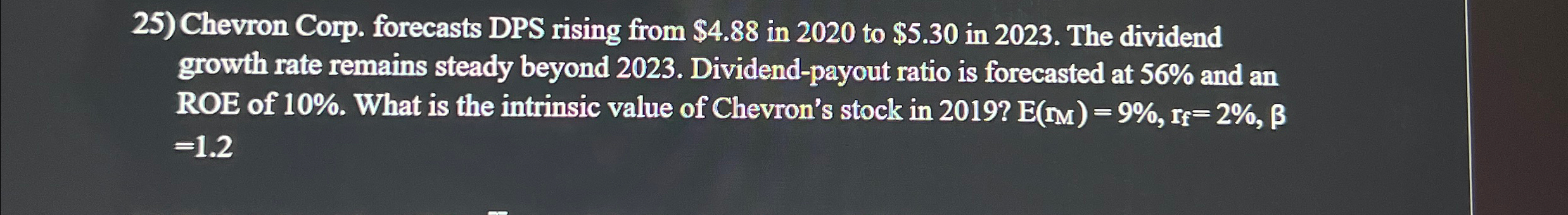

Question: Chevron Corp. forecasts DPS rising from $ 4 . 8 8 in 2 0 2 0 to $ 5 . 3 0 in 2 0

Chevron Corp. forecasts DPS rising from $ in to $ in The dividend growth rate remains steady beyond Dividendpayout ratio is forecasted at and an ROE of What is the intrinsic value of Chevron's stock in

My answer sheet says its but why and how is that the answer? Risk free rate is as it clearly states in the problem

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock