Question: Cheyenne Construction Inc. uses the completed contract method for tax purposes and the percentage completion method for accounting purposes Assume that on July 15,2023 ,

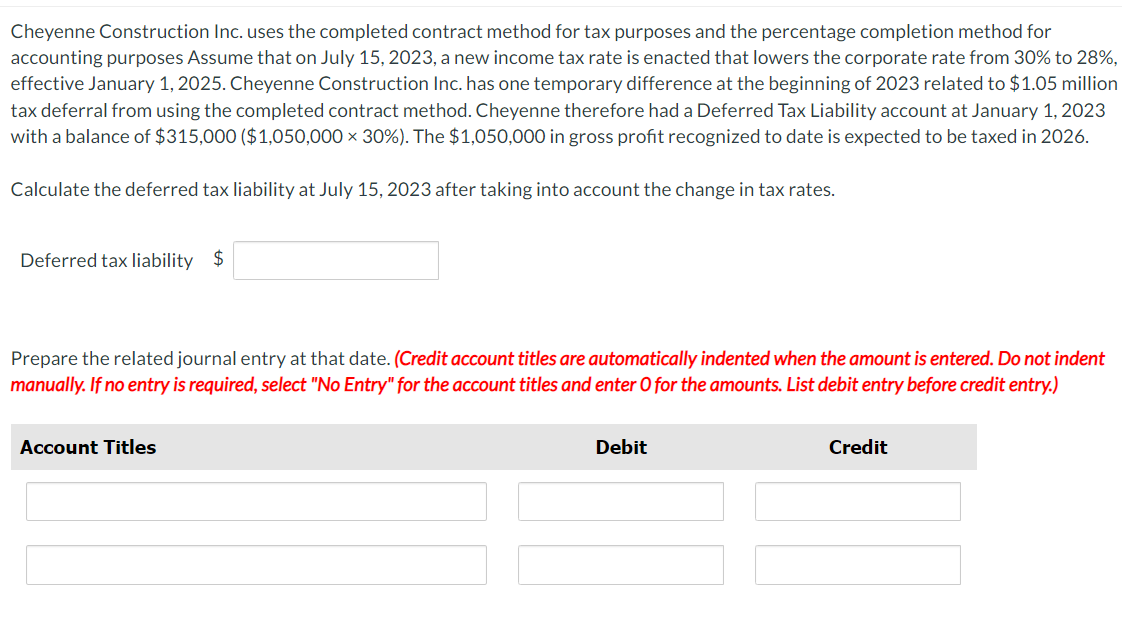

Cheyenne Construction Inc. uses the completed contract method for tax purposes and the percentage completion method for accounting purposes Assume that on July 15,2023 , a new income tax rate is enacted that lowers the corporate rate from 30% to 28%, effective January 1, 2025. Cheyenne Construction Inc. has one temporary difference at the beginning of 2023 related to $1.05 million tax deferral from using the completed contract method. Cheyenne therefore had a Deferred Tax Liability account at January 1,2023 with a balance of $315,000($1,050,00030%). The $1,050,000 in gross profit recognized to date is expected to be taxed in 2026 . Calculate the deferred tax liability at July 15, 2023 after taking into account the change in tax rates. Deferred tax liability $ Prepare the related journal entry at that date. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts