Question: chic Exercises S Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does

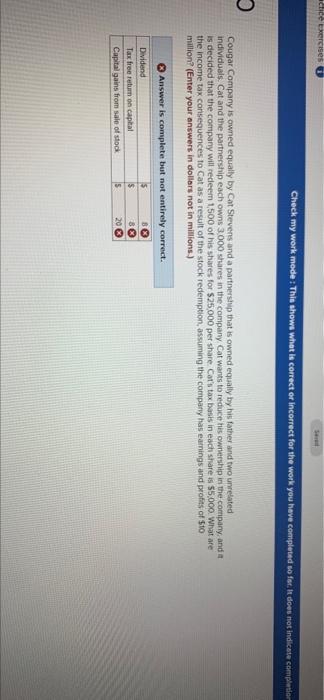

chic Exercises S Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Cougar Company is owned equally by Cat Stevens and a partnership that is owned equally by his father and two unrelated individuals. Cat and the partnership each owns 3,000 shares in the company Cat wants to reduce his ownership in the company, and it is decided that the company will redeem 1,500 of his shares for $25,000 per share Cat's tax basis in each share is $5,000. What are the income tax consequences to Cat as a result of the stock redemption, assuming the company has earnings and profits of $10 million? (Enter your answers in dollars not in millions.) Dividend Answer is complete but not entirely correct. Tax free retum on capital 000 $ $ Capital gains from sale of stock 5 200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts