Question: chicago corporation, which uses the allowance method Recognizing and Classifying the Cost of Long-Term Assets E2A. CONCEPT Fraser Manufacturing purchased land next to its factory

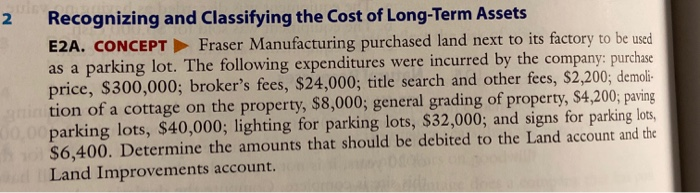

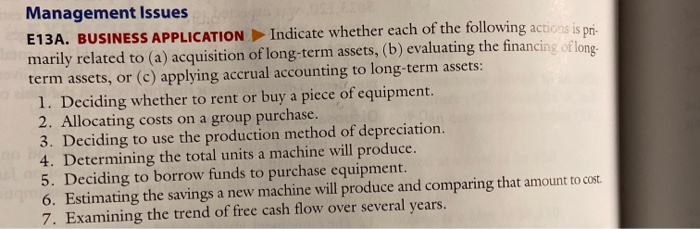

Recognizing and Classifying the Cost of Long-Term Assets E2A. CONCEPT Fraser Manufacturing purchased land next to its factory to be used as a parking lot. The following expenditures were incurred by the company: purchase price, $300,000; broker's fees, $24,000; title search and other fees, $2,200; demoli- tion of a cottage on the property, $8,000; general grading of property, $4,200; paving parking lots, $40,000; lighting for parking lots, $32,000; and signs for parking lots, $6,400. Determine the amounts that should be debited to the Land account and the Land Improvements account. Management Issues E13A. BUSINESS APPLICATION Indicate whether each of the following actions is pri- marily related to (a) acquisition of long-term assets, (b) evaluating the financing of long- term assets, or (c) applying accrual accounting to long-term assets: 1. Deciding whether to rent or buy a piece of equipment. 2. Allocating costs on a group purchase. 3. Deciding to use the production method of depreciation. 4. Determining the total units a machine will produce. 5. Deciding to borrow funds to purchase equipment. 6. Estimating the savings a new machine will produce and comparing that amount to cost. 7. Examining the trend of free cash flow over several years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts