Question: chift problem 1: 30 Points. Gabriel, age 40, and Edith, age 33, are married with two dependents. They reported AGI of $110,000 in 2018 that

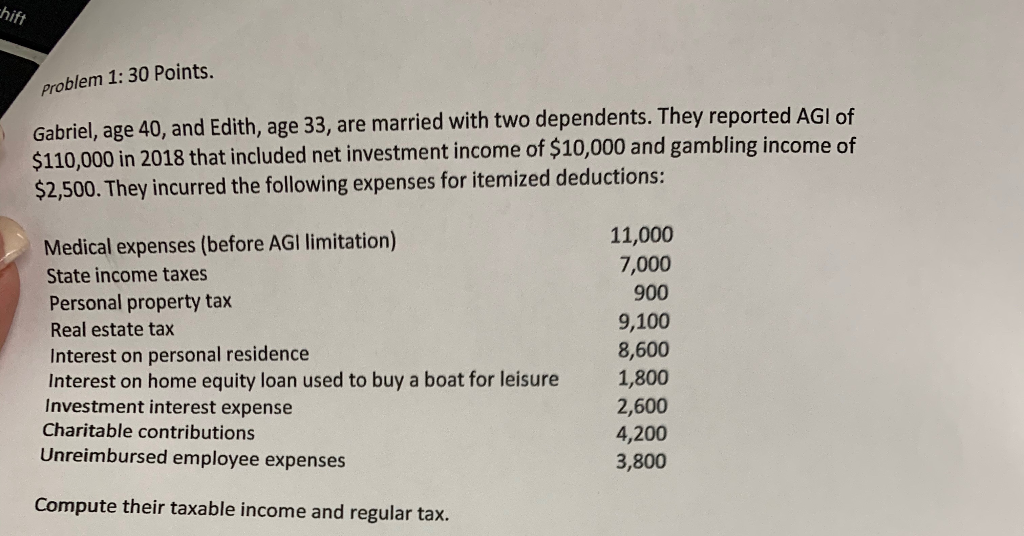

chift problem 1: 30 Points. Gabriel, age 40, and Edith, age 33, are married with two dependents. They reported AGI of $110,000 in 2018 that included net investment income of $10,000 and gambling income of $2,500. They incurred the following expenses for itemized deductions: Medical expenses (before AGI limitation) State income taxes Personal property tax Real estate tax Interest on personal residence Interest on home equity loan used to buy a boat for leisure Investment interest expense Charitable contributions Unreimbursed employee expenses 11,000 7,000 900 9,100 8,600 1,800 2,600 4,200 3,800 Compute their taxable income and regular tax. chift problem 1: 30 Points. Gabriel, age 40, and Edith, age 33, are married with two dependents. They reported AGI of $110,000 in 2018 that included net investment income of $10,000 and gambling income of $2,500. They incurred the following expenses for itemized deductions: Medical expenses (before AGI limitation) State income taxes Personal property tax Real estate tax Interest on personal residence Interest on home equity loan used to buy a boat for leisure Investment interest expense Charitable contributions Unreimbursed employee expenses 11,000 7,000 900 9,100 8,600 1,800 2,600 4,200 3,800 Compute their taxable income and regular tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts