Question: Chill Out ( Pty ) Ltd is a student restaurant registered as a Small Business Corporation ( SBC ) that generates an income of R

Chill Out Pty Ltd is a student restaurant registered as a Small Business Corporation SBC that generates an income of R per month. Every month the food and beverage costs cost of sales amount to R and the company pays R in wages, R in rent for the premises, and R for water and electricity. Assume there are no other costs.

Must Chill Out have a business license to operate? Provide a reference for your answer.

Calculate the business's gross annual income.

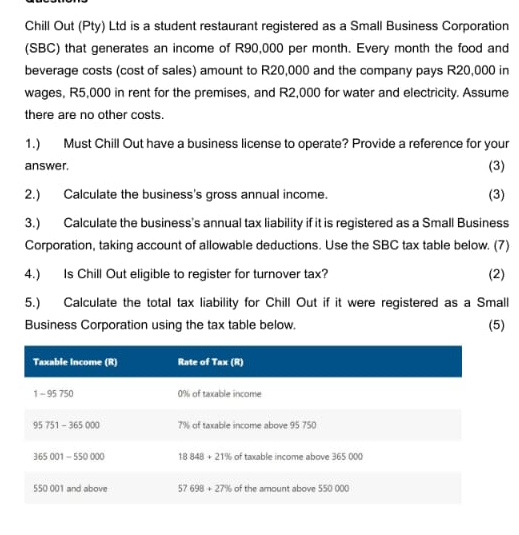

Calculate the business's annual tax liability if it is registered as a Small Business Corporation, taking account of allowable deductions. Use the SBC tax table below.

Is Chill Out eligible to register for turnover tax?

Calculate the total tax liability for Chill Out if it were registered as a Small Business Corporation using the tax table below.

tableTaxable Income RRite of Tax R of taxable income of taxable income above of taxable income above and above, of the amount above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock