Question: Chiptech Inc. is an established computer chip firm with several profitable products as well as some promising new products under development. As such, the ROE

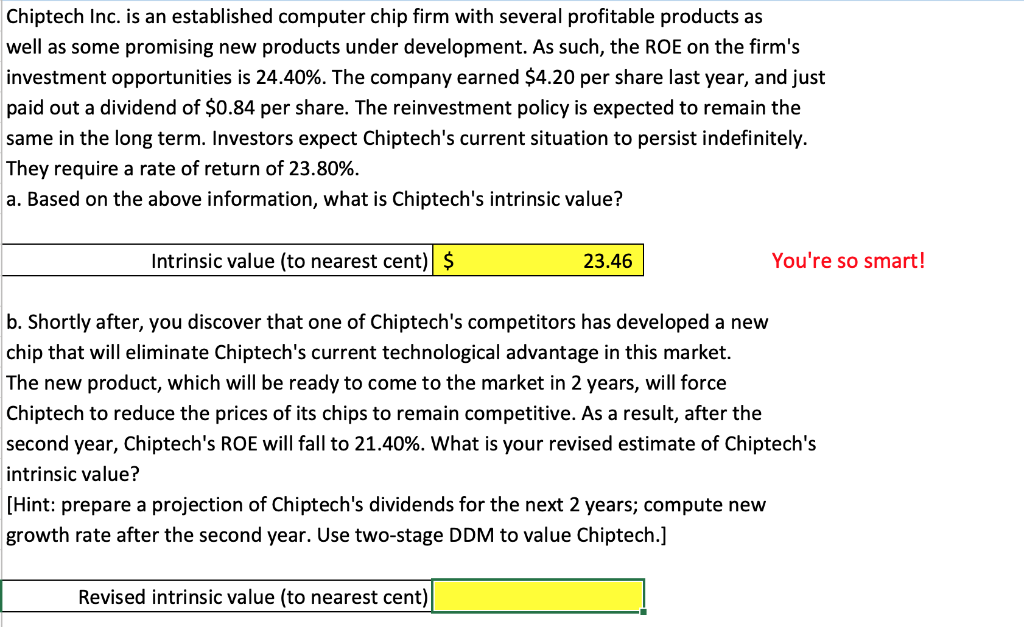

Chiptech Inc. is an established computer chip firm with several profitable products as well as some promising new products under development. As such, the ROE on the firm's investment opportunities is 24.40%. The company earned $4.20 per share last year, and just paid out a dividend of $0.84 per share. The reinvestment policy is expected to remain the same in the long term. Investors expect Chiptech's current situation to persist indefinitely. They require a rate of return of 23.80%. a. Based on the above information, what is Chiptech's intrinsic value? Intrinsic value (to nearest cent) $ 23.46 You're so smart! b. Shortly after, you discover that one of Chiptech's competitors has developed a new chip that will eliminate Chiptech's current technological advantage in this market. The new product, which will be ready to come to the market in 2 years, will force Chiptech to reduce the prices of its chips to remain competitive. As a result, after the second year, Chiptech's ROE will fall to 21.40%, what is your revised estimate of Chiptech's intrinsic value? [Hint: prepare a projection of Chiptech's dividends for the next 2 years; compute new growth rate after the second year. Use two-stage DDM to value Chiptech.] Revised intrinsic value (to nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts