Question: Choose correct answer: * 2 points A company purchased an asset on 1 January 203 at a cost of $1,500,000. It is depreciated over 40

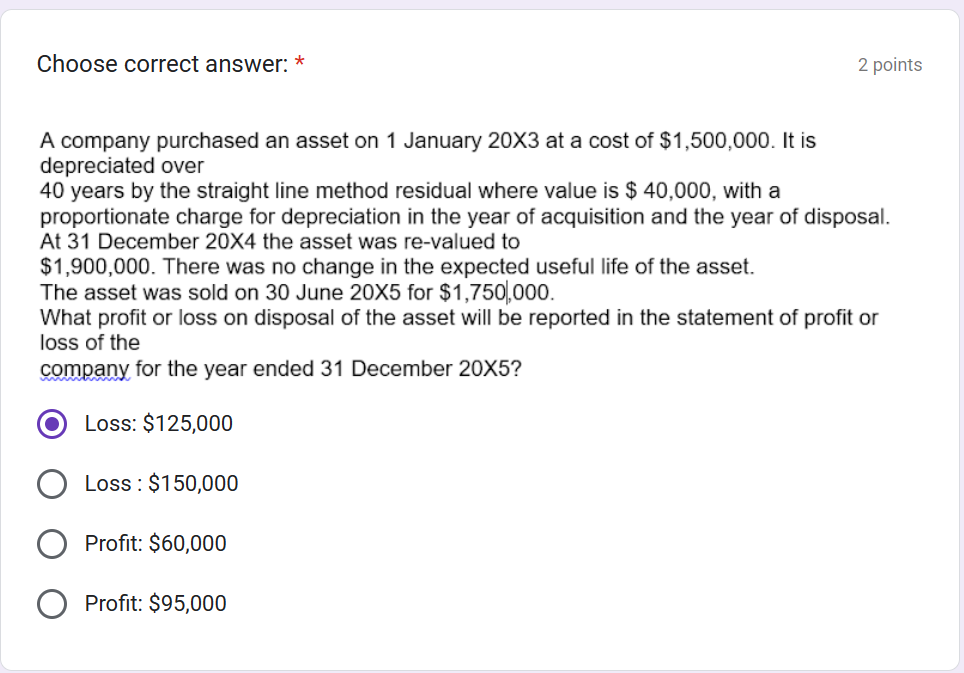

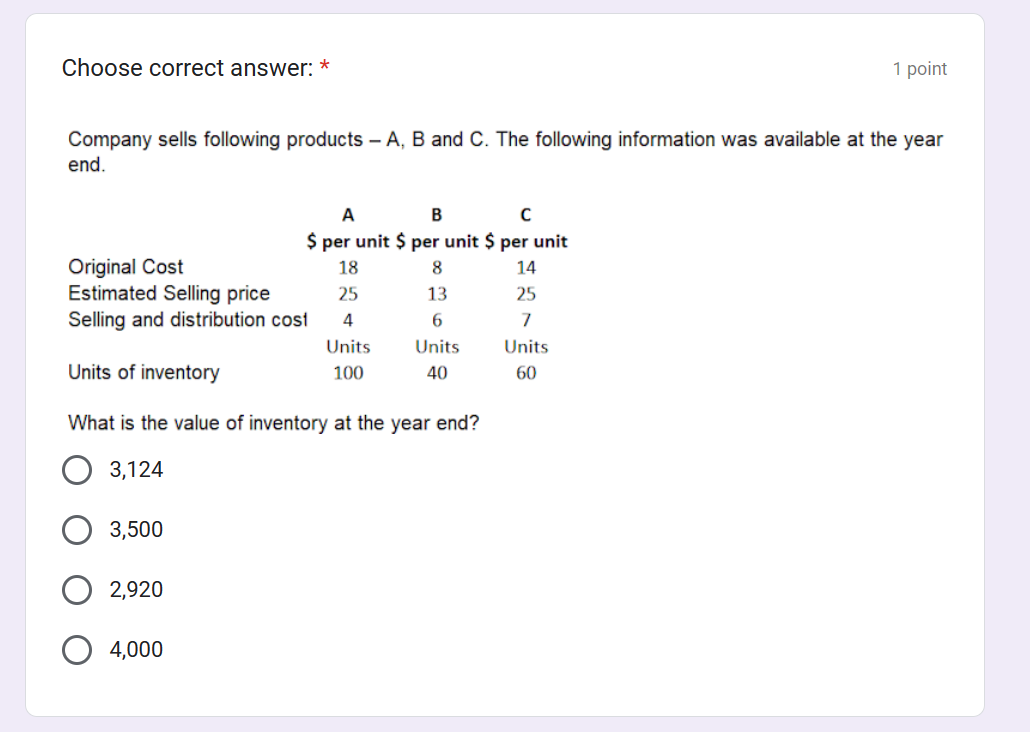

Choose correct answer: * 2 points A company purchased an asset on 1 January 203 at a cost of $1,500,000. It is depreciated over 40 years by the straight line method residual where value is $40,000, with a proportionate charge for depreciation in the year of acquisition and the year of disposal. At 31 December 20X4 the asset was re-valued to $1,900,000. There was no change in the expected useful life of the asset. The asset was sold on 30 June 205 for $1,750,000. What profit or loss on disposal of the asset will be reported in the statement of profit or loss of the company for the year ended 31 December 20X5? Loss: \$125,000 Loss : \$150,000 Profit: $60,000 Profit: \$95,000 Choose correct answer: * 1 point Company sells following products A,B and C. The following information was available at the year end. What is the value of inventory at the year end? 3,124 3,500 2,920 4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts