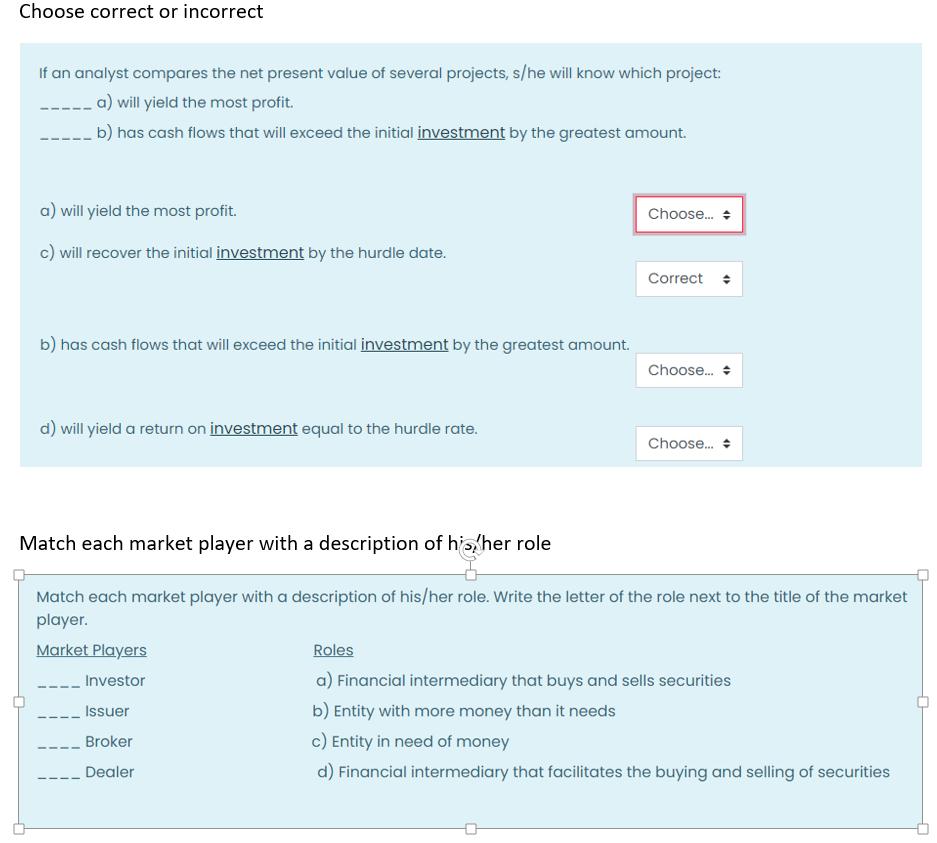

Question: Choose correct or incorrect If an analyst compares the net present value of several projects, s/he will know which project: a) will yield the

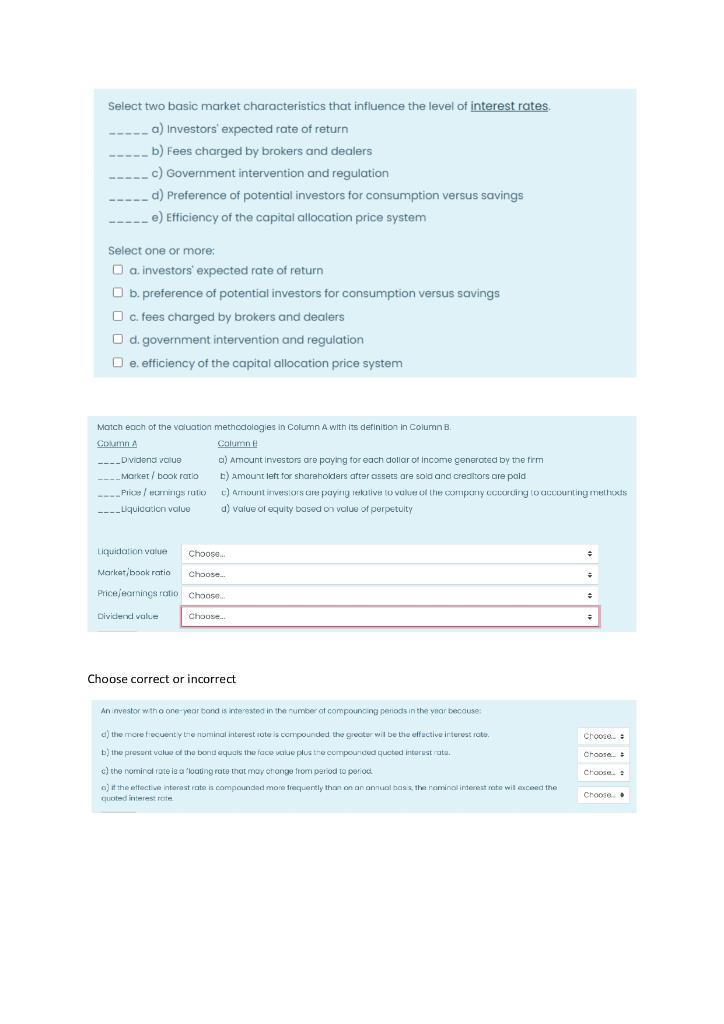

Choose correct or incorrect If an analyst compares the net present value of several projects, s/he will know which project: a) will yield the most profit. b) has cash flows that will exceed the initial investment by the greatest amount. a) will yield the most profit. c) will recover the initial investment by the hurdle date. b) has cash flows that will exceed the initial investment by the greatest amount. d) will yield a return on investment equal to the hurdle rate. Choose... Correct Choose... Choose... Match each market player with a description of his her role Match each market player with a description of his/her role. Write the letter of the role next to the title of the market player. Market Players Investor Issuer Broker Dealer Roles a) Financial intermediary that buys and sells securities b) Entity with more money than it needs c) Entity in need of money d) Financial intermediary that facilitates the buying and selling of securities Select two basic market characteristics that influence the level of interest rates. a) Investors' expected rate of return b) Fees charged by brokers and dealers c) Government intervention and regulation d) Preference of potential investors for consumption versus savings ______ e) Efficiency of the capital allocation price system Select one or more: a. investors' expected rate of return O b. preference of potential investors for consumption versus savings c. fees charged by brokers and dealers O d. government intervention and regulation e. efficiency of the capital allocation price system Match each of the valuation methodologies in Column A with its definition in Column B Coumn A Column B a) Amount investors are paying for each dollar of income generated by the firm b) Amount left for shareholders after assets are sold and creators are paid Amount investors are paying rekalive to value of the company according to accounting methods d) value of equity based on value of perpetuity Dividend value Market/ book ratio Price/eurings rutio __Liquidation value Liquidation value Market/book ratio Price/eamincs ratio Dividend value Choose... Choose..... Choose.. Choose Choose correct or incorrect An investor with a one-year bond is interested in the number of compouncing periods in the year because: d) the more frequently the nominal interest rate is compounded the greater will be the effective interest rate. b) the present value of the bond equals the face value plus the compounded quoted interest rate. c) the nominal rate is a floating rate that may change from period to period o) if the effective interest rate is compounded more frequently than on an annual basis, the nominal interest rate wil exceed the quoted interest rate = = = Choose Choose a Choose Choose

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Answer Choose correct or incorrect If an analyst compares the net present value of several projects ... View full answer

Get step-by-step solutions from verified subject matter experts