Question: choose either a, b, c, d, or e Q-36-38 FACTS: Assume that you are advising Fred, age 30 who is considering selling some of his

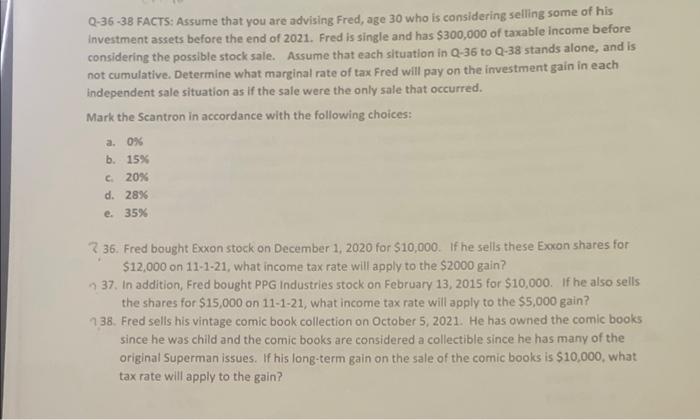

Q-36-38 FACTS: Assume that you are advising Fred, age 30 who is considering selling some of his investment assets before the end of 2021. Fred is single and has $300,000 of taxable income before considering the possible stock sale. Assume that each situation in Q-36 to Q-38 stands alone, and is not cumulative. Determine what marginal rate of tax Fred will pay on the investment gain in each independent sale situation as if the sale were the only sale that occurred. Mark the Scantron in accordance with the following choices: a. 0% b. 15% c. 20% d. 28% e. 35% 2 36. Fred bought Exxon stock on December 1, 2020 for $10,000. If he sells these Excon shares for $12,000 on 11-1-21, what income tax rate will apply to the $2000 gain? n 37. In addition, Fred bought PPG industries stock on February 13,2015 for $10,000. If he also sells the shares for $15,000 on 11121, what income tax rate will apply to the $5,000 gain? 738. Fred sells his vintage comic book collection on October 5,2021 . He has owned the comic books since he was child and the comic books are considered a collectible since he has many of the original Superman issues. If his long-term gain on the sale of the comic books is $10,000, what tax rate will apply to the gain? Q-36-38 FACTS: Assume that you are advising Fred, age 30 who is considering selling some of his investment assets before the end of 2021. Fred is single and has $300,000 of taxable income before considering the possible stock sale. Assume that each situation in Q-36 to Q-38 stands alone, and is not cumulative. Determine what marginal rate of tax Fred will pay on the investment gain in each independent sale situation as if the sale were the only sale that occurred. Mark the Scantron in accordance with the following choices: a. 0% b. 15% c. 20% d. 28% e. 35% 2 36. Fred bought Exxon stock on December 1, 2020 for $10,000. If he sells these Excon shares for $12,000 on 11-1-21, what income tax rate will apply to the $2000 gain? n 37. In addition, Fred bought PPG industries stock on February 13,2015 for $10,000. If he also sells the shares for $15,000 on 11121, what income tax rate will apply to the $5,000 gain? 738. Fred sells his vintage comic book collection on October 5,2021 . He has owned the comic books since he was child and the comic books are considered a collectible since he has many of the original Superman issues. If his long-term gain on the sale of the comic books is $10,000, what tax rate will apply to the gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts